We have recently received several questions from clients & colleagues about news related to the MOVEit security breach.This article contains some more information about what happened, what to do if you were affected, and also some general information on data security and identify theft.What happened?In May 2023, a zero-day vulnerability was discovered in MOVEit, a managed file transfer software used by thousands of organizations around the world. The vulnerability was exploited by the Russian ransomware group CL0P, who stole data from over 340 organizations and 18 million individuals. The organizations affected include educational institutions, government agencies, healthcare organizations, and businesses of all sizes. It’s recommended that organizations that use MOVEit should apply the latest security patches and review their security policies to ensure that they are adequately protecting their data.What can you do?If you were affected by the MOVEIT Security Breach, there are a few things you can do to manage a case of identity theft:Contact your professional service providers including your advisor, accountants, etc. Let them know what happened so they can prepare accordingly.Place a fraud alert on your credit report. This will let creditors know that you may be a victim of identity theft and require them to…

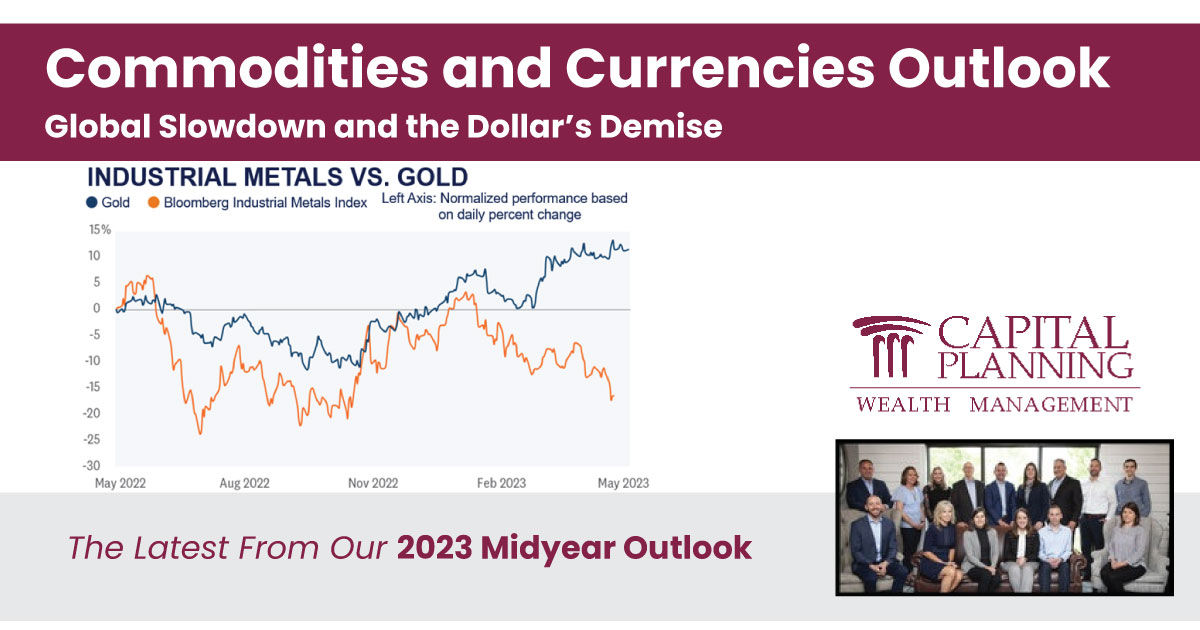

Commodities Outlook: Global Slowdown Concerns And Prospects For RecoveryAs the possibility for China’s reopening finally became a reality, analysts cautioned that the demand for industrial metals from the world’s second largest economy would help ignite a bout of inflation. Initially there was a delay in economic activity, as COVID-19 cases escalated once Beijing authorities lifted strict testing and lockdown measures. And as outlined by Communist Party leadership at the National People’s Congress (NPC) in early March, the target for 2023 economic growth would be “around 5%.” That target is less than what analysts had projected, and predicated on personal consumption since there was no indication of large infrastructure projects requiring industrial metals on a large scale.In terms of China’s long established requirements for crude oil and crude oil products, as the world’s largest importer of oil, projections for crude oil prices were lifted as expectations that domestic and international travel, and manufacturing activity, would pick up markedly.But concerns that the global economy was nearing the cusp of a downturn placed significant pressure on oil prices, despite a significant cut in production by OPEC+. According to OPEC+ officials, they will continue to monitor prices and adjust production based on demand, with…

We’re more than six months into 2023 and the global dynamic has shifted. An attempt by Chinese President Xi Jinping to forge a negotiated settlement to end the Russia-Ukraine conflict was thwarted by an unflinching determination by both sides to win at all costs. An ally of Vladimir Putin, Xi is the latest world leader to offer a framework for a cessation to the fighting, but so far it has been met with caution and suspicion given China’s current relationship with Russia. That Xi has emerged onto the world stage, following China’s nearly three year COVID-19-related shutdown, and is enjoying praise for his successful peacemaking deal between Saudi Arabia and Iran, lends credibility to his attempt to broker an accord between Russia and Ukraine. The deal also helps underpin China’s unrelenting determination to establish a global leadership position, as it seeks to broaden its trade and political relationships, and weaken the economic authority of the U.S. A major component of China’s global outreach includes a determined effort to destabilize the U.S. dollar as the still uncontested primary global reserve currency, while it seeks to legitimize and install the yuan as a major reserve currency. Moreover, as China continues to build…

As noted previously, short-term interest rates are at levels last seen in the early 2000s. Moreover, due to the elevated fed funds rate and the subsequent carryover into the U.S. Treasury market, the Treasury yield curve is the most inverted since the early 1980s. That is, shorter-term Treasury securities outyield longer maturity securities. This has finally allowed investors to generate a return on cash. But economists like to remind us there is no such thing as a free lunch. In investment parlance, that just means all investments carry risk, even cash. So where is the risk that economists warned us about? The big risk with cash is reinvestment—that the currently elevated rates won’t last and upon maturity, investors will have to reinvest proceeds at lower rates.The Fed’s goal has been to take the fed funds rate into restrictive territory to make the cost of capital prohibitively expensive to slow aggregate demand, which should allow inflationary pressures to abate. Then what? Well, after winning its fight with inflation, markets expect the Fed to start cutting rates early next year. After keeping rates at these elevated levels, the Fed will then likely take the fed funds rate back to a more neutral…

In our latest spotlight, we take a different approach and speak with the now youngest member of our office, intern Ty Everitt. We found out that not only does he have an affection for a certain sport and winter holiday, but also that his favorite part of our meetings MIGHT just be the food that comes with it. Learn more from the FULL spotlight here: What was your first paying job? My first paying job was giving baseball lessons. I was 16 at the time and wanted to earn money to buy a car. Baseball is something I’m passionate about and I enjoy sharing my knowledge, so giving lessons was a no brainer. I gave multiple lessons a week working with kids on their hitting, pitching, and defense. My favorite part of it was getting to know each kid individually and developing a relationship over our common interest in baseball. What sort of duties do you have at work? I handle duties at Capital Planning ranging from organizing our clients’ information in our online files to picking up lunch for the office from a local restaurant. I take pride in doing a lot of the back-end work for the office.…

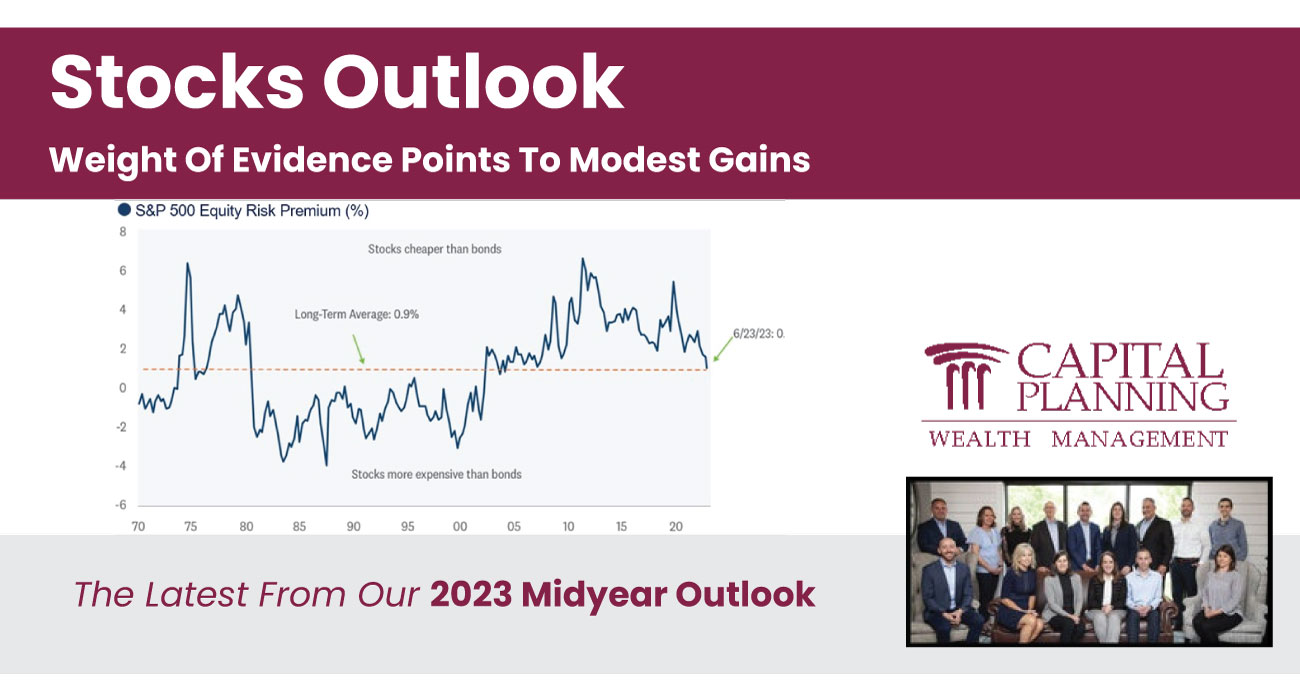

Stocks Outlook: Weight of Evidence Points to Modest Gains Outlook 2023: finding balance conveyed the difficulty equity markets had in 2022 making the transition from a market driven by macroeconomic risks to one focused on business fundamentals. In the first half of 2023, progress was made toward better balance as inflation fell and interest rates stabilized, but macroeconomic risks remain top of mind as a potential recession looms. History Often Rhymes We discussed some favorable historical seasonal and cyclical patterns in Outlook 2023. One was the average 10% gain for the S&P 500 in the 12 months following the end of a Fed rate hike cycle. Another was the stock market’s impressive track record following a down year, with an average gain of over 15% the following year, and gains in 15 out of 18 of those years. There are several indicators that help put the current market environment into perspective and suggest additional, but likely modest, gains may lie ahead [Image Below]. One historical precedent that suggests a bumpier ride for stocks is the average performance before the start of a recession. Specifically, the S&P 500 has fallen 1.4% on average during the six months before the start of…

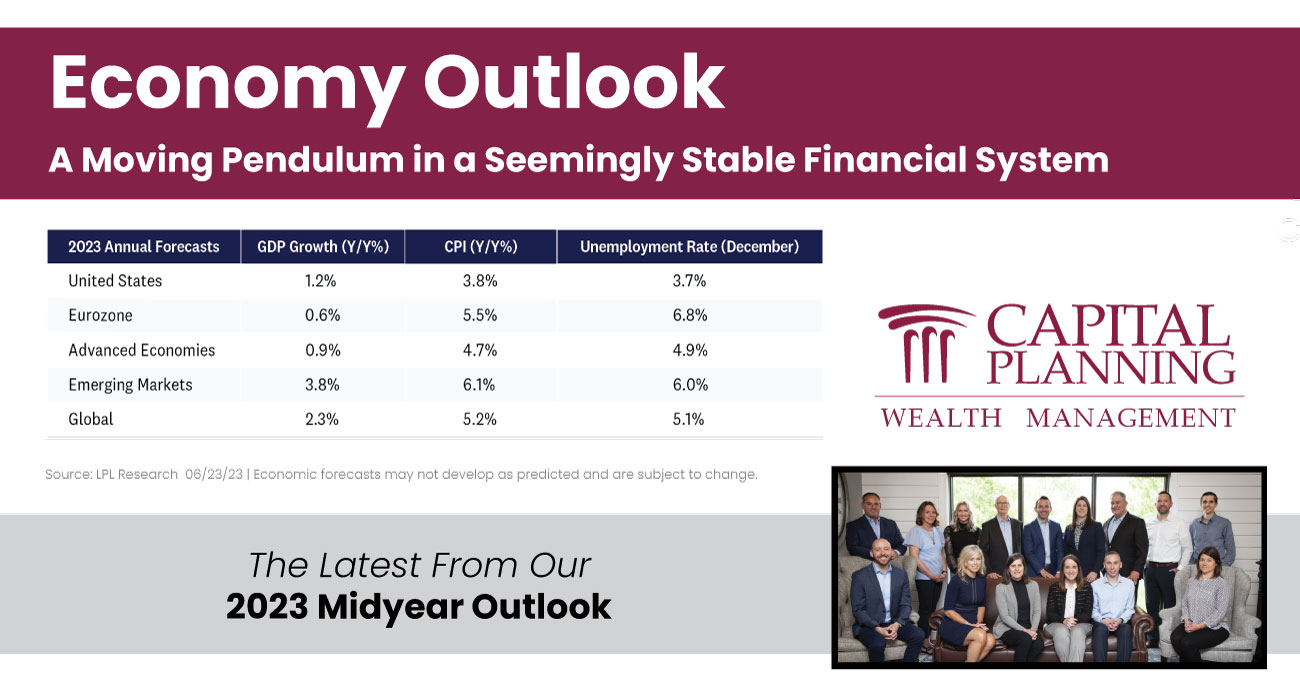

A Moving Pendulum in a Seemingly Stable Financial SystemFrom interest rates and inflation to the job market and recession, we anticipate there will be a number of shifting elements in the economy for the remainder of the year and potentially into 2024. At the May meeting this year, the Fed increased its policy rate for the tenth consecutive time, pushing the upper bound of the fed funds rate to 5.25%, the highest since August 2007. The Fed’s aggressive rate-hiking campaign has been a focus for investors for over a year. Frankly, investors are probably ready to move on from the Fed being the centerpiece of most conversations.We expect the Fed to change strategy during the latter half of 2023 for at least two reasons. First, the Fed should have less pressure to react to a tight labor market as the job market is set to cool throughout the remainder of the year. And second, the Fed will likely be less concerned inflation could get out of control from sticky-services inflation, since we expect services prices to ease. One nagging inflation component that will ease in the coming months is rent, as a record number of new apartment units under construction…

In our latest staff spotlight, we chatted with our Insurance Specialist here at Capital Planning, Katherine Janis, FPQP™. Not only did we learn that Kate has a special place in her heart for her children and the occasional scoop of ice cream, but she may just be the world’s biggest Rick Springfield fan?Learn more here from the FULL spotlight here:What’s something you are proud of? This is easy for me to answer - hands down, it’s my children. All four of my children. Each one is different and unique in their own way, and I love them all so much. You only get 18 years with them to cram everything that they need to know before they go off and make their own choices away from your nest. When I look at my children, my heart is full - full of love and admiration for the individuals they are becoming. I am so proud, and I feel blessed!Have you ever met anyone famous?RICK SPRINGFIELD…several times. I am known as the President of his fan club. I have been a Rick Springfield fan since the early 80’s, and at this point I have seen him six times. He is still rockin’ at…

In our latest "Staff Spotlight," we have the pleasure of speaking with Wealth Advisor John W. Sullivan II, CLU®, ChFC®, MSFS, RICP®.Jack's diverse interests and unique experiences make for an intriguing conversation. From his love for winter adventures, interest in military history, to his unwavering loyalty to one specific college team (the Nittany Lions), we sure learned a lot! Read on for more:What’s your favorite season?I enjoy all of the seasons, each for different reasons. But unlike most people we know, who want to escape the cold and go south during the winter, my wife and I long for good snowstorms. We look forward to heading “north” in the winter to our home in New Hampshire to go snowmobiling and snowshoeing and sitting by the woodstove at the end of the day.What’s the best book you’ve read recently?I really enjoy reading early American history and U.S. military history, particularly the Civil War. I have quite a library of non-fiction material in those categories, including good biographies of our earlier leaders. Some of my favorite authors are David McCullough (who passed away in 2022 and the author of “John Adams” and “1776”) and Stephen Ambrose (wrote “Band of Brothers” and “Undaunted…

Today in our latest “Staff Spotlight”, we are chatting with Rebecca Berger, CFP®, RICP®, FPQPTM. What did we learn? Well, not only did we find out what seasons and holidays Becky loves, but we found out the unique place she ate on her wedding day. Learn more below:What’s your favorite food? Chick-fil-A. My husband Lee and I love going to Chick-fil-A! In fact on our wedding day we left the church and went to Chick-fil-A!What’s your favorite holiday?Christmas is my favorite holiday. Christmas is a time were I get to spend a lot of time with my family and I really enjoy that. One of my favorite Christmas traditions growing up was on Christmas Eve all the women in the family would make cinnamon buns and the men would all do last minute Christmas shopping. One of my favorite traditions these past couple of years is going to Longwood Gardens with some friends.What’s your favorite season? I like Spring and Fall. I really enjoy in the springtime when all the trees and flowers start to bloom. It just feels like the world has been transformed and everything has come back to life. I also have been enjoying fall. It’s nice…

Planning for an unpredictable future can feel overwhelming, with so many decisions to make it can be hard to know if you're going to have enough money to support yourself through retirement.

In this guide, experts from the Capital Planning Team have simplified the 10 steps you can take, so that you can live a life without worry, sfe in the knowledge that your financial future is secure.