We had a great time sitting down with Wealth Advisor Robert Everitt, CFP® to learn a a bit more about him, including how he spent his early summers on a roof (it's still his favorite season), and who inspires him. Learn more below! What was your first paying job? "My first ever job was working with my dad, who worked part time as a roofer and sider on houses. I was in my early teens when I worked with him. I spent many a summer’s day on a roof, and on the ground as the cleanup crew. It taught me many valuable lessons, one of which was to stay focused. You never wanted to lose focus and step on a nail, or lose your balance on a roof!" What’s your favorite season? "Without a doubt, it’s the summer time. I love all the activities that are associated with summer, and warm weather. Baseball, golf, sunlight, swimming, longer days, are all things I associate with the summer. One of the motto’s that I like is… “if your not sweating, your not living”. I am a big fan of warm weather and the sun, even if it involves a little sweat!" Who…

The latest episode of the debate between stock market bulls and bears has gotten more interesting. For every valid point from one side, there’s an equally compelling argument on the other side. Perhaps the best reason for the debate is the uniqueness of this environment. The pandemic and its aftermath don’t come with a historical playbook. We haven’t been here before. So we’ll just recognize that the outlook is uncertain, weigh the pros and cons, glean what we can from the past, and give it our best shot. Call us cautious bulls.Topic 1: EconomyBull case: Consumer is resilient, the labor market is strong, wages are rising, and inflation is coming down steadily.Bear case: Inflation is still high, leading indicators are signaling recession, manufacturing activity and housing market have slowed significantly.Background: The global economy will likely slow from the upper-2% range in 2022 down to slightly above zero in 2023 (Figure 1). Much depends on China's growth path now that it has largely abandoned its overzealous Zero-COVID-19 policy. If the U.S. falls into recession, the chances are it would occur during the first half of 2023 and will not likely be as deep as the 2008 recession, which was initiated by a fundamentally flawed financial…

As you may have seen, there’s big news from Congress on the retirement front. The passing of SECURE ACT 2.0, a giant piece of bipartisan retirement security legislation, could present significant opportunities for your retirement savings strategy.While the full piece of legislation is nearly 400 pages long, there are a few key points that we’d like to highlight below.Below are the 10 key elements that we’d like to share with you. As always, feel free to reach out with any questions you may have.1) Changes to Required Minimum DistributionsThe SECURE Act of 2019 raised the age for RMDs from 70½ to 72. SECURE 2.0 further raises the RMD age from 72 to 73 in 2023, and 75 in 2033. Earlier drafts of SECURE 2.0 had a phase-in period, with a gradual increase to 75 by 2033; the final version of the bill does not include a phase in and will simply raise the RMD age from 73 to 75 in 2033.Additionally, SECURE 2.0 reduces the penalty tax for failures by an individual to take the minimum distribution from 50% to 25%. Further, if the failure is corrected in a timely manner, the excise tax is reduced from 25% to 10%.…

After two years of disruption due to the COVID-19 pandemic, we were searching for some kind of return to normalcy, while at the same time, still experiencing the aftereffects of the pandemic. Some of those aftereffects included the imbalances created by the fiscal, monetary, and public health policy put in place to address the pandemic— and the process of addressing those imbalances has been disorienting at times. If 2022 was about recognizing imbalances that had built in the economy and starting to address them, we believe 2023 will be about setting ourselves up for what comes next as the economy and markets find their way back to steadier ground—even if the adjustment period continues.The Federal Reserve (Fed) spent 2022 aggressively fighting inflation by raising interest rates. In 2023, we expect the Fed to find that point where it can stop raising rates, as inflation starts to come under control. The Fed’s efforts to control inflation throughout 2022 pulled interest rates off of extremely low levels that were historically unprecedented. While that has been painful for bond investors, for the first time in a decade, savers can now get an attractive yield, and 2023 will be more focused on how to…

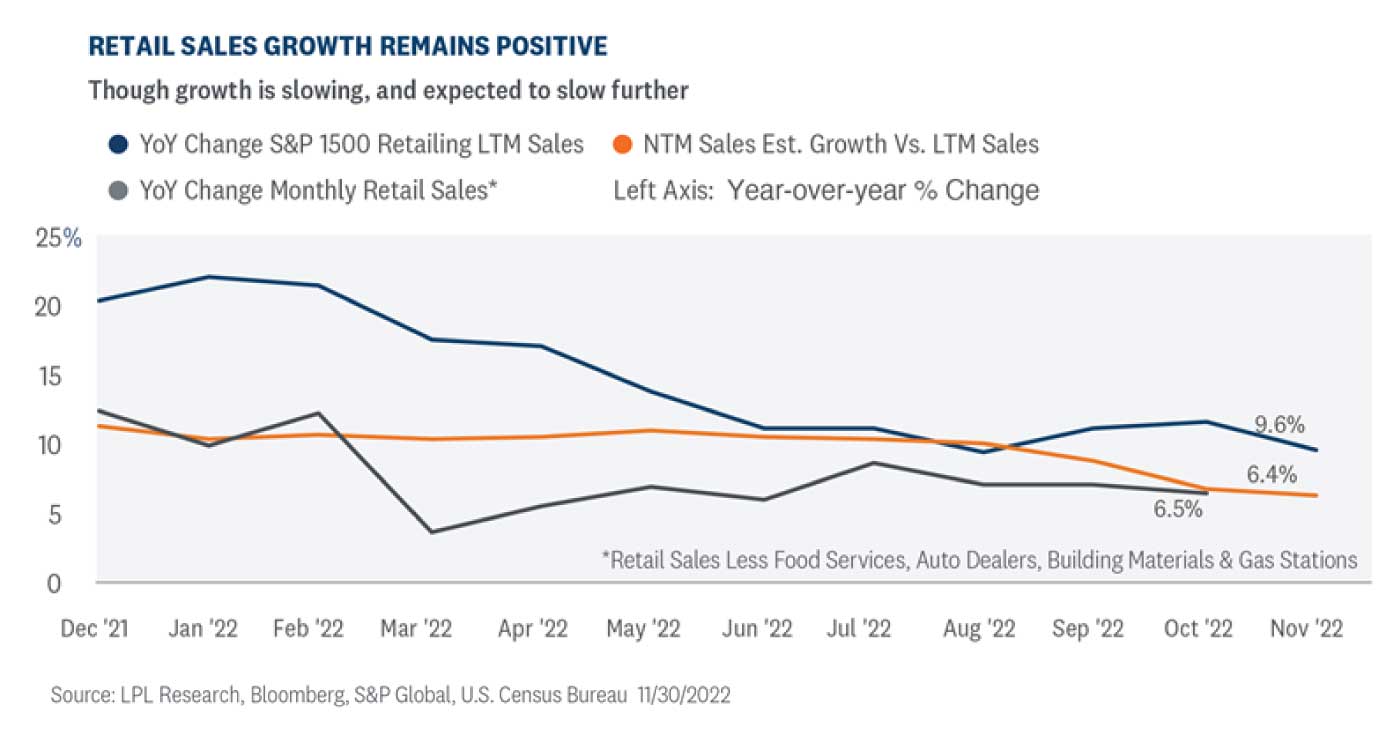

Economic and corporate data support the initial strong reads on holiday retail sales despite the macro headwinds, reinforcing the idea that today’s consumer is in a better position than usual at this point in the business cycle. However, consumers were likely tapping into credit and using savings to support spending. In this week’s Weekly Market Commentary we share insights on publicly traded retailers, analyze their underperformance year to date, and look forward to 2023.Will a Resilient Consumer Support Holiday Retail?Consumer behavior during the Thanksgiving weekend is often a good predictor of overall holiday sales and the recent data point to growth this year. Consumers came out in droves on Black Friday, pushing nominal retail sales up over 10% from a year ago in both online and brick and mortar stores [Figure 1]. Elevated inflation this past year appeared to marginally impact the consumer but despite high prices, consumers were active on the Friday after Thanksgiving. Consumers were especially interested in heading to restaurants after Thanksgiving Day – spending at restaurants was over 20% above last Black Friday, partially driven by higher food prices but also supported by a resilient consumer. Retail Sales Data Supports Initial Holiday Shopping TrendsEconomic and corporate data support…

Are you making charitable donations at year’s end? If so, you should know about some of the financial “fine print” involved, as the right moves could potentially bring more of a benefit to both you and your chosen charity.Keep in mind, this article is for informational purposes only and is not a replacement for real-life advice. Make sure to consult your tax, legal, or accounting professionals before modifying your charitable gifting strategy.Evaluate the ImpactHow can you maximize the impact of your gifts? First, consider giving to a qualified charity with 501(c)(3) nonprofit status. Also, visit CharityNavigator.org, CharityWatch.org, or GiveWell.org to evaluate a charity and learn about how effectively it utilizes donations. If you are considering a large donation, it is often wise to ask the charity involved how it will use your gift.If you’re still working, you may want to check with your employer. Some companies match charitable contributions made by their employees, an often-overlooked opportunity to give back.Itemize to OptimizeTo deduct charitable donations, you must itemize them on I.R.S. Schedule A. So, you’ll need to log each donation you make. Ideally, the charity will provide you with a form to document proof of your contribution. If the charity does…

The growth vs. value debate has been pretty one-sided in 2022, with value outperforming growth for a sustained period for the first time in almost 15 years. However, the debate is heating up as investors begin to consider whether the pendulum will swing back to growth if inflation and interest rates decline in 2023. In this week’s Weekly Market Commentary we look at the factors driving value’s 2022 outperformance, the technical trading setup for growth and value, and what to look for in the coming months. Value vs. Growth – Value Takes 2022 One equity market debate discussed frequently in the LPL Research Strategic & Tactical Asset Allocation Committee (STAAC) is the growth vs. value style reversal experienced the past 12 months. Until November of last year, value had underperformed growth for nearly 15 years. Since then, value has outperformed growth for the longest sustained period since 2003–2007. How long might the current period of value’s outperformance last, and what are the catalysts that could end this cycle and pivot the market’s favor back to growth? First, a bit of background. Value and growth stocks are simply stocks that exhibit greater “value” characteristics (e.g., comparatively inexpensive relative to earnings) or “growth” characteristics…

After the Great Recession hit, far too many Americans found themselves without any savings to get through higher prices caused by inflation and the hardships of unemployment. With recessionary periods approaching, it's important to learn from our past mistakes. Getting into some simple saving habits can really help you down the line. Social Security and unemployment checks are a lifeline to many, but usually not enough to maintain a decent living standard. The rule of thumb for emergency savings is three to six months’ worth of living expenses. In light of the economic slump and the sheer number of long-term unemployed workers, most advisors tell clients to save even more, at least six to 12 months of expenses. Make Savings Automatic One way to do this is to set up an automatic deduction program through your employer, or through your bank. You can set up a program that transfers a certain amount from your checking account to your savings. Once established, you can change it, but you probably won’t (because we all get too busy and it’s easier to keep things as they are). Also, once you learn to plan your finances around the remainder of your paycheck not transferred…

Did you recently add a second comma to your bank balance? Has a recent financial event raised your net worth to the next level? It's an exciting time, whether it's the result of your long-term goals (e.g., from the sale of a business), a windfall transfer of wealth, or a key promotion. You're probably already considering how to protect and manage your wealth. Keep in mind that this article is for informational purposes only and is not a replacement for real-life advice. Consult tax, legal, and accounting professionals before modifying your financial strategies as your income changes. This article was written to provide insights into a few related factors you may wish to consider. Estate Strategy on a New Playing Field You may already have an estate strategy in place. However, reaching a new level of wealth may be an excellent time to revisit your approach. More wealth can mean a larger estate and more complex estate issues. For example, it may be time to consider a living trust. You create a living trust while alive and fund it with the assets you choose to transfer therein. The trustee (typically you) has full power to manage these assets. But using…

With the recent and prolonged market volatility and economic uncertainty, the demand for financial advice is at an all-time high. And when markets are unpredictable, as they have been in recent years, that’s when investors most often seek financial advice to cope, according to a Cerulli report. The report confirms that we’ve experienced three cycles of volatility throughout the last decade, and that in every year following the volatility, there’s been a spike in demand for advisor guidance. As further proof of the need for guidance from a trusted financial professional, in 2021, investors who traditionally self-directed their investments reported reaching out for advice for the first time. Believe it or not, volatility is something that can be embraced – not feared – with a long-term investment horizon. Below are five reassuring facts around the markets that may help you keep your eyes on the horizon, weather the storm, and come out the other side stronger for it. Here are 5 reassuring facts around market volatility: 1.) Volatility may be uncomfortable … but it’s normal. Just like muscle fatigue is part of any intense training program, volatility is an unavoidable part of the investment process as well. It’s easy to…

Planning for an unpredictable future can feel overwhelming, with so many decisions to make it can be hard to know if you're going to have enough money to support yourself through retirement.

In this guide, experts from the Capital Planning Team have simplified the 10 steps you can take, so that you can live a life without worry, sfe in the knowledge that your financial future is secure.