Turning Dispersion and Volatility into OpportunitiesWe came into 2024 with two key considerations in mind — greater micro and macro dispersion and asset volatility. We witnessed the unfolding of the micro and macro dispersion (an increasing gap between best- and worst-performing economies and assets) during the first half of the year, which translated into a healthy trading environment for many liquid alternatives (Alts) and hedge fund strategies. Global macro was a standout as it monetized the accelerating de-coupling of the global economy and policy actions, as well as equity market neutral managers (small overall net exposure to the stock market) which delivered positive outperformance from both long and short positions.Looking ahead, we expect market divergences to continue and volatility to pick up. At the macro level, major central banks have become more vocal about how each region will take independent action from one another and have taken their initial steps towards their goals. They will continue to decide their own path, which should bring about greater macro divergences. This is not just a story about developed-market countries either. Emerging market economies have also begun to unlink themselves from one another, making dispersion a global phenomenon.At the micro level, the decline…

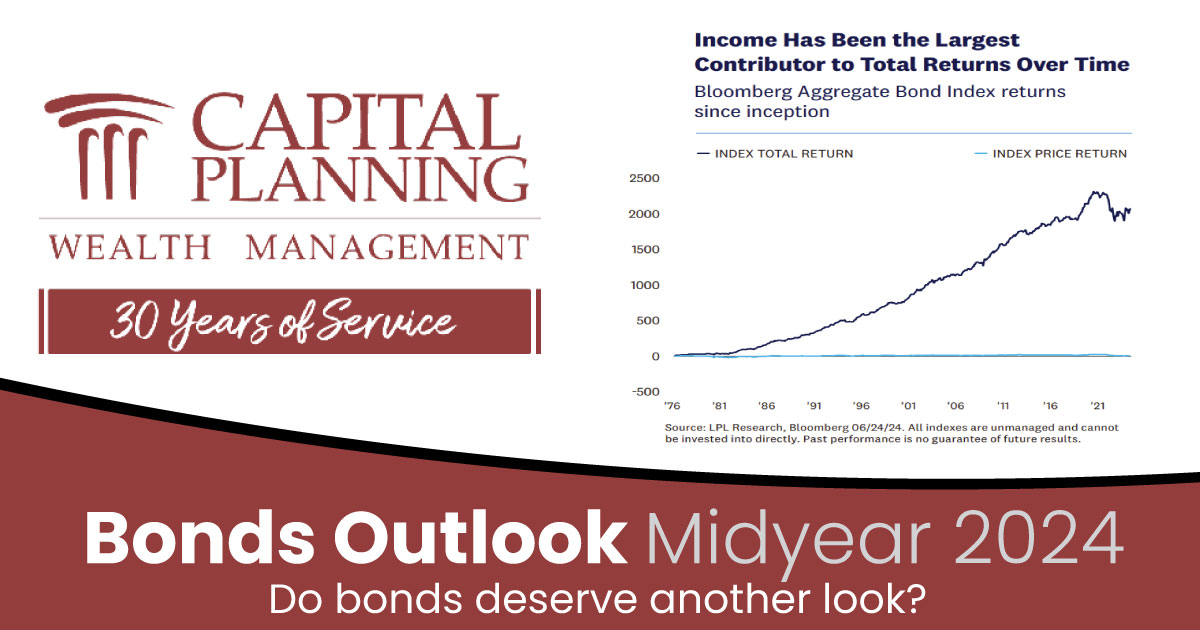

Market pricing for Fed rate cuts has been volatile this year, which has meant bond prices have been volatile as well. As mentioned in the economic section, we expect the Fed to cut rates this year once or possibly twice, with more rate cuts likely coming in 2025. But while markets continue to wait for rate cuts, a lingering question remains: How low will the Fed be able to take the fed funds rate absent a financial crisis? The answer to that question has major ramifications on the overarching shape of the U.S. Treasury yield curve and, by extension, the ability for longer-maturity Treasury yields to fall meaningfully from current levels during this Fed rate cutting cycle. The U.S. Treasury yield curve has been inverted since 2022 — currently the longest yield curve inversion in history. When the yield curve is inverted, shorter maturity Treasury yields are higher than longer-maturity Treasury yields. This is not the normal shape of the yield curve. In normal times, the yield curve is upward-sloping, meaning longer-maturity Treasury yields are higher than shorter-maturity Treasury yields, which makes sense since longer-maturity Treasury securities carry more risk as interest rates can fluctuate more over time and investors…

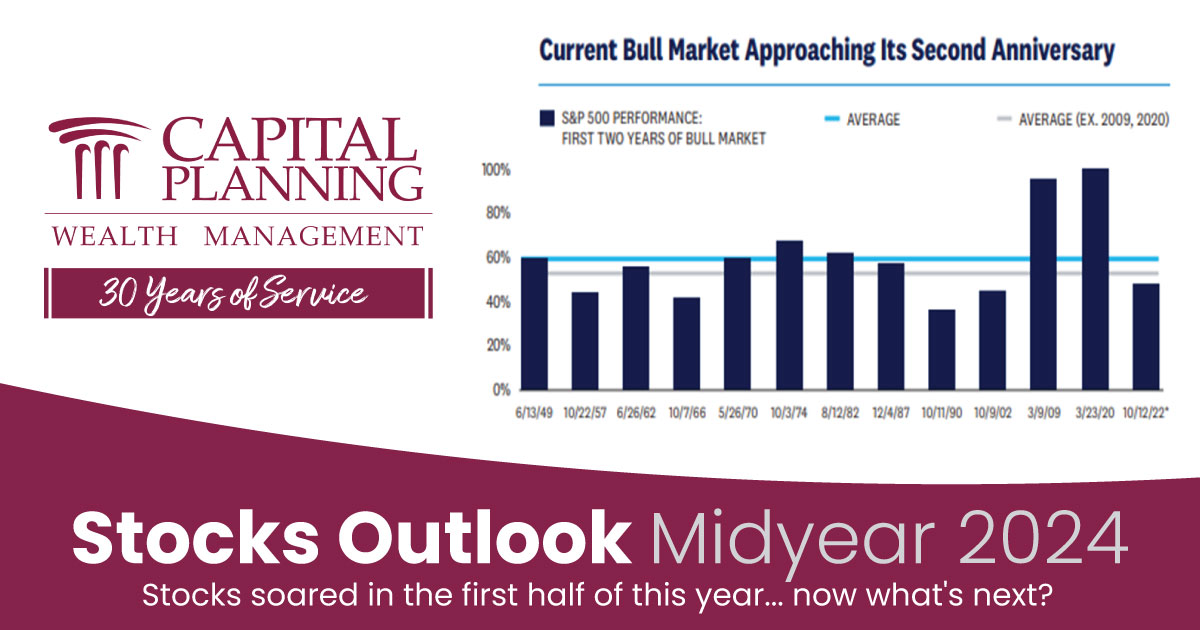

As we continue our midyear outlook for 2024, this week we are taking a deeper look at stocks. Economic Growth Surprised in the First Half Much of the strong first half for stocks can be explained by the economy’s resilience. As 2023 ended, recession risk was elevated, and the economy appeared to have little cushion if conditions deteriorated. Now, with the benefit of hindsight, we know the economy enjoyed plenty of cushion — cushion that it hasn’t needed. Stocks were not pricing in enough economic or profit growth. Now that the bar has been raised, what will stocks do for an encore? Gauging Upside Using Historical Market Patterns Markets tend to move in cycles, as we discussed in Outlook 2024: A Turning Point, so we can use historical patterns to help form an opinion about where stocks might go in the second half of the year. We regularly say history doesn’t always repeat, but it often rhymes. Let’s start with basic market cycles. The S&P 500 has gained 52.8% during the current bull market that began on October 12, 2022. That may sound like a lot, but it is actually short of the historical average gain for a two-year-old bull…

A 2024 Midyear OutlookWith the midpoint of 2024 here, we are taking a look back at the start of the year while simultaneously looking ahead to what’s on the horizon. Over the next few weeks, we will be offering fresh insights into the economic and market landscape. This includes important topics such as the economy, the stock market, the bond market, geopolitics, the election, and more.This week, we kick things off with an economy review.We Have a Delayed Landing, But Still a LandingRecent data on refinancing activity provides a clue on why the economy has experienced a delayed landing. The housing market often explains a lot of what is happening in other sectors of the economy, and this time is no different. Roughly one-third of mortgages were refinanced in the quarters following the pandemic recession of 2020.¹ And because of 2020's extremely low mortgage rates, these homeowners lowered their monthly payments, thereby increasing their disposable income. Other homeowners took advantage of healthy home equity and took cash out to support more spending. The incredible impact of such historic refinancing activity caught many, including us, by surprise. In addition to the oft-mentioned excess savings from stimulus and temporarily curtailed spending, improved…

April showers brought May flowers as markets placed greater importance on economic growth and corporate profits than the “higher for longer” interest rate messages from the Federal Reserve (Fed). In fact, the S&P 500 ended May above where it ended March. So, as you prepare for summer vacations, how much should you worry about your stock portfolios?First, based on history, stocks tend to do just fine between Memorial Day and Labor Day, with the S&P 500 rising 1.8% on average between holidays with gains 70% of the time (source: Bespoke). Also consider stocks tend to do better the rest of the year when they rise in May, with an average June–December gain of 5.4% with positive returns 73% of the time. Seasonality is not particularly worrisome.Investing involves much more than seasonality. Looking at the U.S. economy, slower growth in the first quarter of about 1.3% is expected to be followed by a slight pickup in the second quarter. Consumer spending did slow in April as inflation remains elevated and may slow further now that excess savings from the pandemic have generally been spent. However, business investment — particularly in artificial intelligence — is helping pick up the slack. The Fed’s…

The first quarter earnings season is largely in the books, and it was excellent. In fact, S&P 500 earnings per share (EPS) would have been up double digits in the quarter if not for a big loss Bristol Myers Squibb (BMY) absorbed in an acquisition. Even with that nearly three-point drag from the drugmaker, a nearly 7% increase in earnings — the biggest since the first quarter of 2022 — is impressive. Big tech strength was again the primary driver, and estimates impressively rose.Impressive NumbersOn April 8, 2024, we predicted three to four percentage points of upside to the then-consensus estimate of 3%. It turns out that estimate will be right on the money, with earnings growth tracking near 7%. That sounds good, and it is, but it could’ve easily been quite a bit better. If not for BMY, that number would be about 9.5%. Remove biotech and pharmaceuticals and S&P 500 EPS would be up 10.5%, with about 20 S&P 500 companies still left to report.That said, all results count, as there are always big drags from somewhere. But that doesn’t change the fact that earnings are currently growing at a solid mid-to-high-single-digit pace with a realistic opportunity for…

Wall Street narratives can change relatively quickly as investors translate new information into speculation over future events. One of the widely publicized narratives at the beginning of the year was the ‘Goldilocks’ economy. This theme was used to describe an ideal economic state, where inflation is not too hot and growth is not too cold, analogous to the porridge that was “just right” in the popular Goldilocks and the Three Bears children’s story. Stocks tend to do well against this backdrop, evidenced by the S&P 500’s 10.2% price gain in the first quarter — a rally that also included 22 record highs and a maximum drawdown of only 1.7%.On Main Street, narratives often change with the seasons. I was reminded of this when watching snowfall quickly turn into rain during a volatile week of weather in the Midwest. Inevitably, as the narrative goes, April showers bring May flowers, at least that is the hope. With markets, hotter-than-expected inflation data underpinned a volatile few weeks of price action and delivered the proverbial April showers, driving the S&P 500 down 5.5% this month, as of April 19.Akin to spring, there is also hope for May flowers blooming in the form of a market rebound.…

In our latest Capital Planning Spotlight, we spoke with our newest intern, Matt Tuley.What did we learn? Well Matt has a great book recommendation, a go-to sport, and was drawn to one specific subject in school.Read on to find out more!What’s the best book you’ve read recently? I recently enjoyed reading A Random Walk Down Wall Street, by Burton G. Malkiel. This is a wonderful introductory book on stock markets and makes many investing concepts easier to understand.Do you have any hidden talents or hobbies? I enjoy spending my free time on the golf course. I had the pleasure of spending two summers working at a golf course during college. I love the competition and free-mindedness while being on the course.What was your favorite subject in school?My favorite subject in school was Mathematics. I have enjoyed working with numbers from a young age and this ultimately led to myself seeking a job in Finance.

Let's take a look at the latest news with the economy, highlighted by several bright spots.Strong Job Momentum Has SurprisedIn the latest employment report, the Bureau of Labor Statistics (BLS) issued revisions to the prior 12 months, and it turns out that firms added more jobs in 2023 than originally reported. As last year ended, investors thought businesses added 2.7 million jobs, but after revisions, businesses added roughly 3.1 million.Job Growth Healthier Than Originally ReportedThe stronger employment figures tell us that businesses and households have stronger momentum going into 2024, and therefore, we believe it is prudent to increase our forecasts for economic growth. Headwinds remain but on an annual basis, we believe the U.S. and global economy is poised for a bit stronger growth this year than originally forecasted last year.It’s More Than Just JobsAnother factor that suggests the economy could move through this year with fewer headaches is the improving credit conditions. The latest Senior Loan Officer Survey tells us credit supply and credit demand are getting into better balance. Financial conditions improved in recent months as fewer banks tightened credit conditions in Q4 because fewer firms were pessimistic about demand. As investors digest the experience of loan…

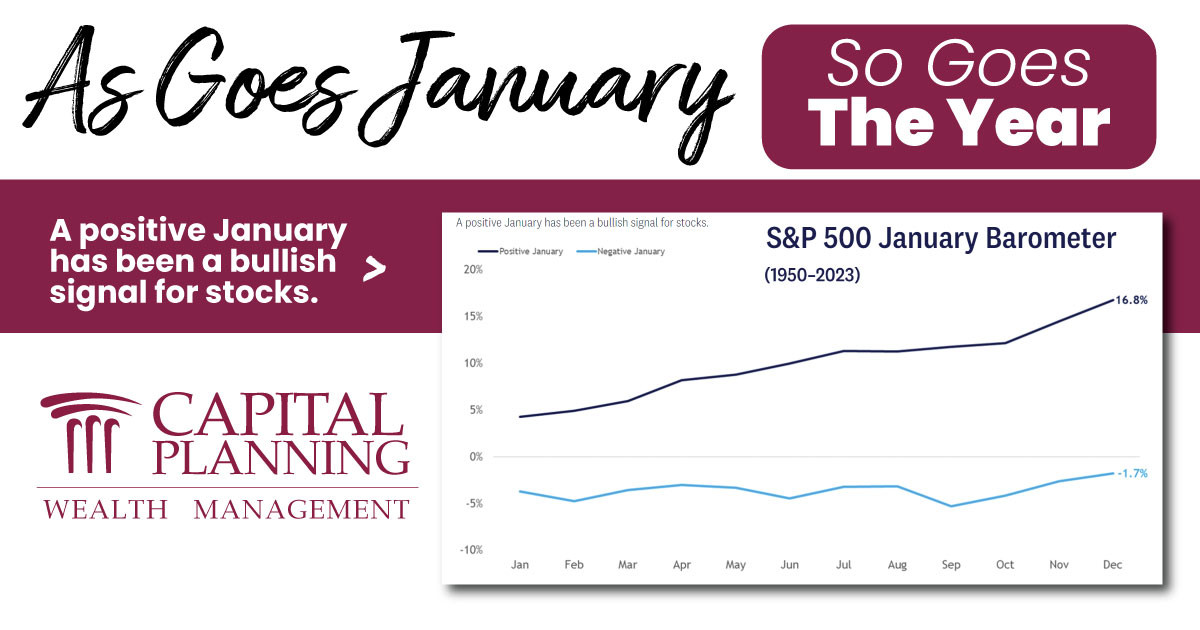

After a relatively slow start, the S&P 500 rallied during the back half of January and closed out the month with a gain of 1.6%. Buying pressure was relatively narrow, as declining shares on the index modestly outpaced advancers. Similar to 2023, a few mega-caps did most of the heavy lifting. Shares of NVIDIA (NVDA), Microsoft (MSFT), and Meta (META) contributed 80% of the S&P 500’s total return during the month.From a historical perspective, a positive January has been a bullish sign for stocks. Yale Hirsch, creator of the Stock Trader’s Almanac, first discovered this seasonal pattern back in 1972, which he called the January Barometer and coined its popular tagline of ‘As goes January, so goes this year.’As highlighted in the chart below, the popular Wall Street maxim has stood the test of time. Since 1950, the S&P 500 has posted an average annual return of 16.8% during years that included a positive January. Furthermore, the index generated positive returns during these years 89% of the time. In contrast, when the index traded lower in January, annual returns dropped to -1.7%, with only 50% of occurrences yielding positive results.S&P 500 January Barometer (1950–2023)Source: LPL Research, Bloomberg 02/01/24Disclosures: Past performance…

Planning for an unpredictable future can feel overwhelming, with so many decisions to make it can be hard to know if you're going to have enough money to support yourself through retirement.

In this guide, experts from the Capital Planning Team have simplified the 10 steps you can take, so that you can live a life without worry, sfe in the knowledge that your financial future is secure.