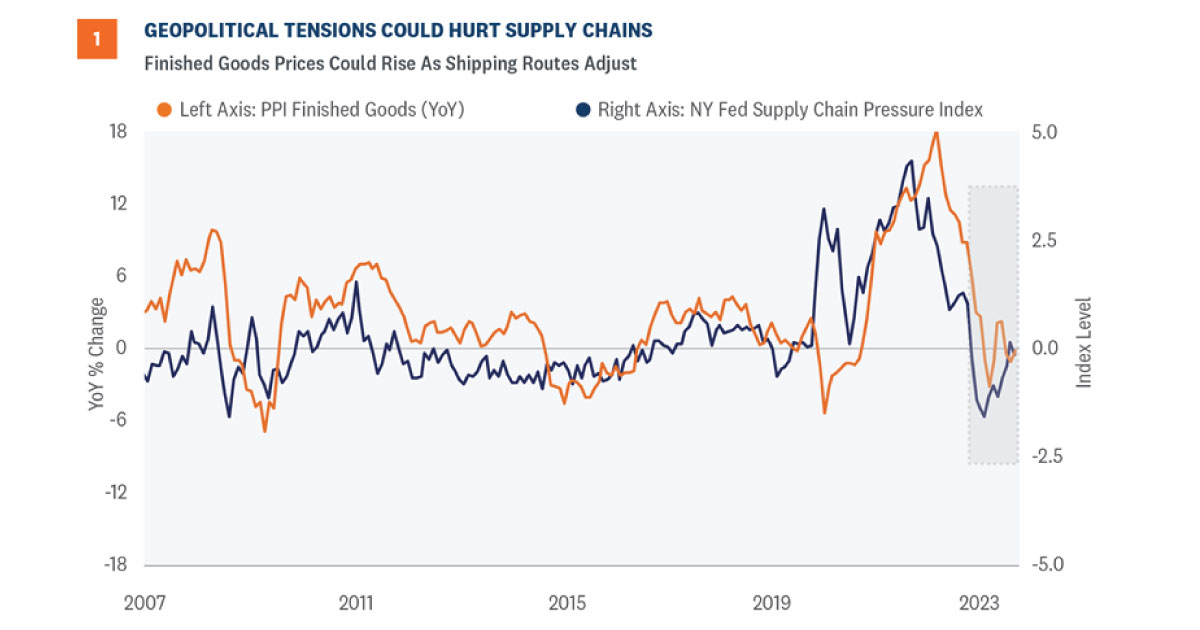

Shipping disruptions in the Red Sea could temporarily impact goods prices but not at the same magnitude as during the pandemic. Tight financial conditions, slowing economic growth, and a disinflationary trend all support the Federal Reserve’s (Fed) pivot away from tightening monetary policy to easing in the new year. Despite these longer term trends, rates possibly got ahead of themselves in recent weeks, exhibiting higher volatility.Supply Chain Shocks Not the Same Magnitude as Pandemic OnesThe global economy experienced multiple shocks in recent times from the Russian attacks on Ukraine, atrocities in the Middle East, the seating of an unconventional president in Argentina, and most recently, a crisis in the Red Sea. Yet, markets and the economy remain surprisingly resilient. Could the recent challenges in inter-continental shipping contribute to a resurgence of inflation and hamper the Fed’s plans this year?During the depth of the pandemic, shipping lanes backed up due to understaffed ports and insufficient supply of intermodal containers. Additionally, activity at production plants was hampered from governmental restraints and inconsistent labor supply. Investors often overlook the length of time for the backlogs to clear — ports didn’t return to more normal levels until the middle of 2022.1 The lack of supply…

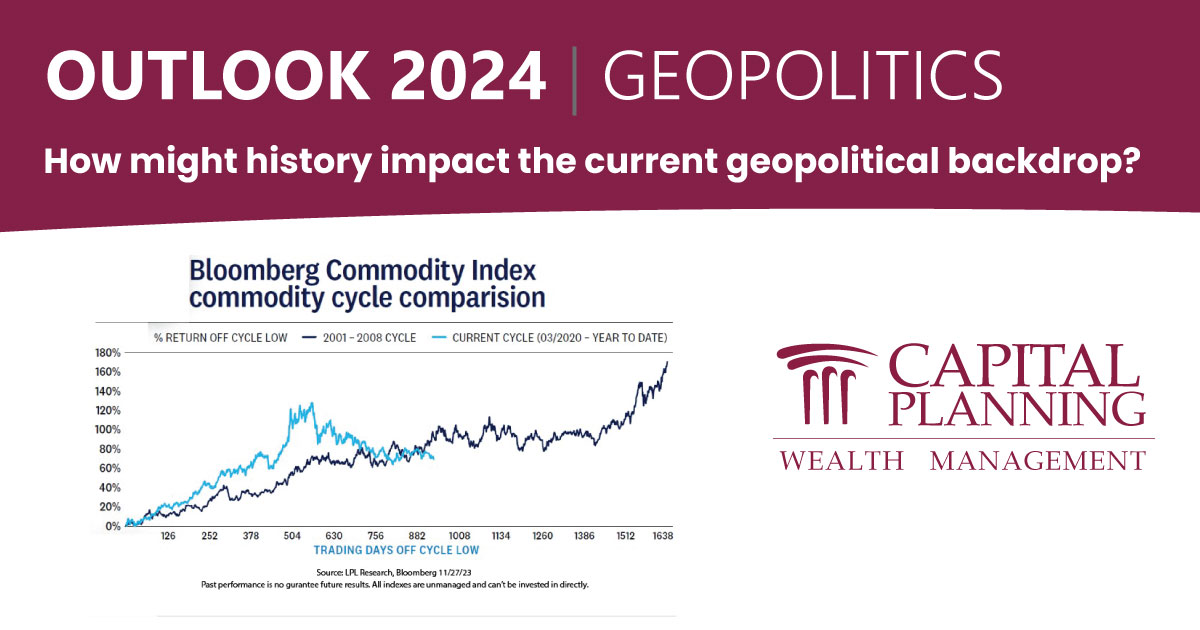

We can’t look back in history without seeing eras marked by war and conflict. With the onset of the war in the Middle East, geopolitical concerns have broadened from the ongoing Russia/Ukraine conflict and implications for a wider confrontation along the NATO border. The recent military threat imposed by Hamas has also brought the Middle East back into the spotlight, with questions around how long the Israeli/Hamas conflict will last. From an investment standpoint, any geopolitical tension has the potential to affect the markets. There’s also an impact on commodities, meaning we’ll want to keep a closer eye on those asset classes producing goods in these regions of conflict.Despite rising tensions and uncertainty across the globe, investors should keep a long-term orientation and favor a well-diversified portfolio. We believe that diversification across sectors, regions, and asset classes can help investors hedge against and make the most of volatile markets.TECHNOLOGY’S ROLE IN U.S.-CHINA RELATIONSDespite attempts to foster deeper commercial ties, the U.S. has two goals dominating its relations with China. The first goal is keeping China from acquiring advanced semiconductor technology that can be applied to its expanding military buildup. The second is establishing a U.S. domestic semiconductor supply chain infrastructure. Protectionism,…

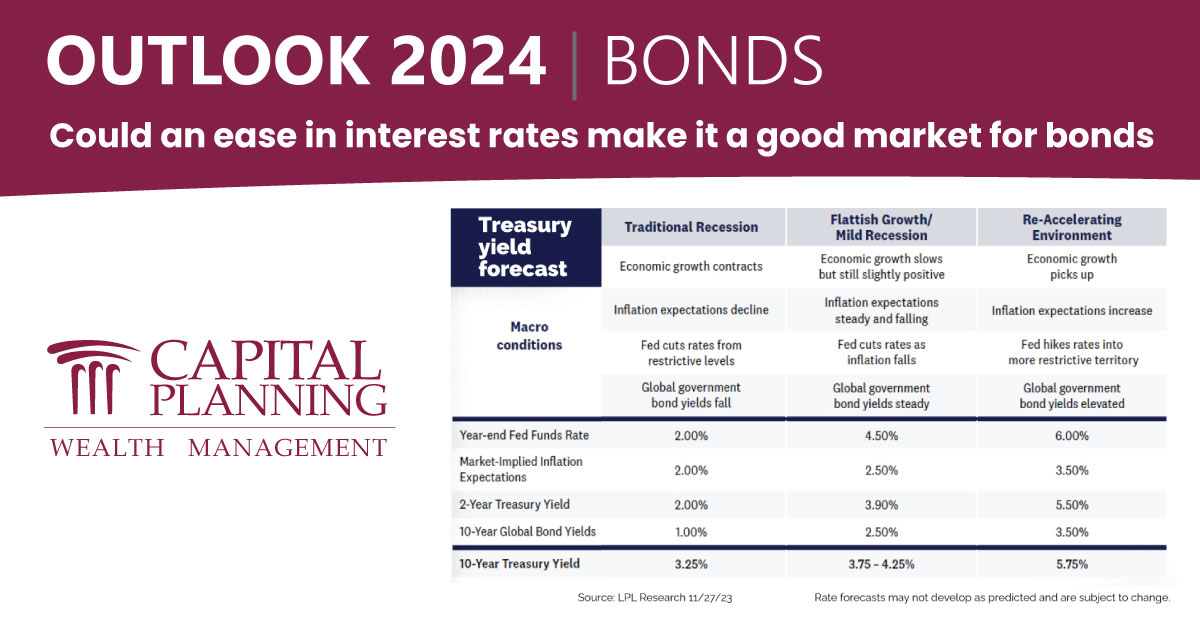

For the first time in over 10 years, we’re seeing new growth opportunities in the fixed-income market. Some might say the turning point for bonds is a return to normal, one where investors can expect decent returns without the risk that comes with stocks. This is a key reason we believe investors can feel confident about bonds for 2024.RATES LEAD THE WAY U.S. Treasury yields moved higher in 2023 with the interest rate on the 30-year Treasury bond briefly trading above 5% for the first time since 2007. The steady increase in interest rates (which makes bond prices go down) hit the intermediate and longer-term Treasury bonds the hardest. There are several reasons we saw higher yields, but rates moved higher alongside a U.S. economy that continued to outperform expectations. As the U.S. economy continued to perform better than expected, interest rates went up, and the chances for a recession went down, which in turn led the Fed to stick to its “higher for longer” approach—rather than lowering rates to stave off a looming recession.As the economy has continued to be better than expected, we have witnessed some spikes in Treasury bond yields. While we think the 10-year Treasury yield…

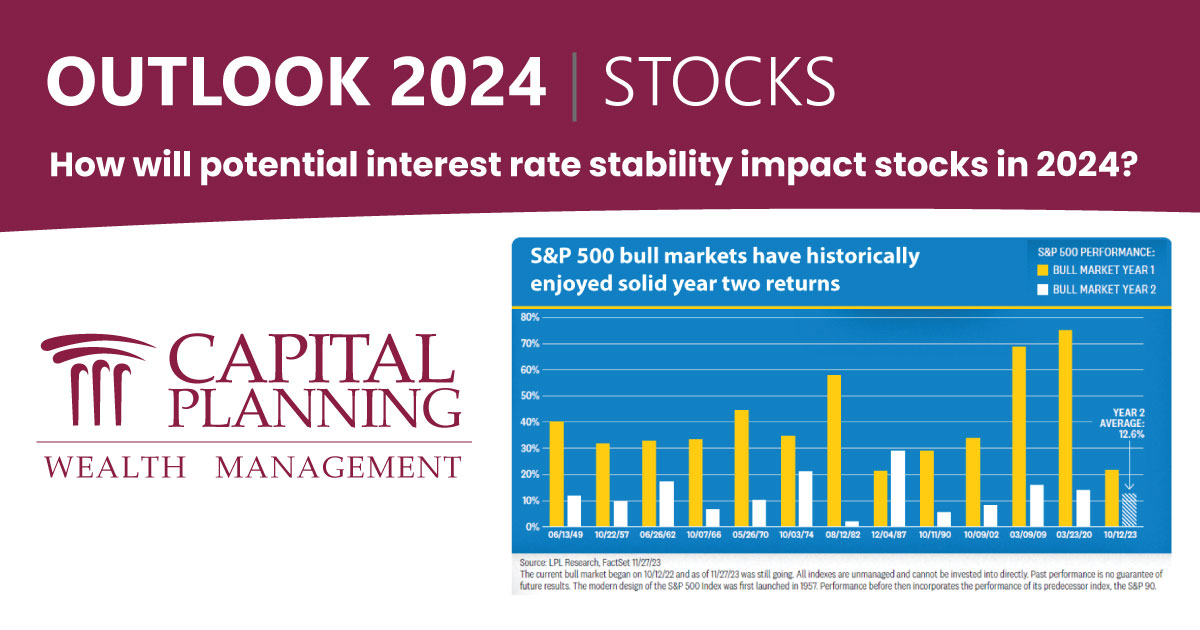

Following the Fed’s aggressive rate-hiking campaign to combat the massive inflation surge, the stock market will become one where participants are focused on interest rate stability. We expect inflation will come down further, and as it does, interest rate stabilization should help support stock valuations, just as some of the biggest headwinds for corporate America begin to reverse.ECONOMIC CYCLEThis one has been unique, to put it mildly given the highly uneven recovery in recent years coming out of the pandemic. As previously discussed, a mild, short-lived recession in 2024, followed by recovery later in the year is our basecase scenario. The uncertainty that comes with anticipating a recession may limit stock gains as 2024 begins. But it could bolster investor sentiment midyear, as is typical coming out of an economic trough (the lowest part and turning point of an economic cycle). Keep in mind, the market’s reaction to the economic cycle in 2024 could be muted, given that stocks essentially priced in a recession in 2022 following the surge in growth of the postpandemic economy.BULL MARKET CYCLEThe young age of this bull market historically points to solid gains ahead. The start of the current bull market (began in Oct 2022)…

The economy grew faster than expected in recent quarters, unemployment remained historically low, and activity in some sectors grew (e.g., homebuilding), despite the macro headwinds. The labor market seemed to be a boon for workers in prime positions to bargain for better pay and more benefits. In 2024, we believe a recession is likely to emerge as consumers buckle under debt burdens and use up their excess savings, but a Fed that is sensitive to risk management might provide an offset by taking interest rates down again in the new year. Inflation may remain a concern, but the Fed will likely be less laser-focused given the trajectory is going in the right direction. In sum, we expect a mild recession to occur in 2024, although that may usher in some interest rate decreases from the Fed and offset some of the economic and market impact.Turning points are often marked by a series of significant events, but it’s also valuable to put those events in context. For the U.S. economy, the event that might accompany this time of change could be a recession. However, if we look back on the post-pandemic economy, many things have gone better than expected.THE RECESSION CALL…

Just as we saw in 2023, the IRS has announced some adjustments to contribution limits as we head into the new year. Starting January 1, 2024, the annual contribution limits for several popular retirement savings plans will be increasing. This presents an excellent opportunity for you to save more towards your retirement goals.Here is a breakdown of the key updates:401(k), 403(b) and Most 457 Plans:The annual elective deferral limit increases by $500, from $22,500 in 2023 to $23,000 in 2024.Traditional and Roth IRAs:The annual contribution limit increases by $500, from $6,500 in 2023 to $7,000 in 2024. This applies to both traditional and Roth IRAs, allowing you to save even more for retirement.The IRA catch-up contribution limit for people aged 50 and over remains $1,000 for 2024. Catch-up limits allow older plan participants to put away more money, since they have less time to save.SIMPLE IRAs:The amount individuals can contribute is increased from $15,500 in 2023 to $16,000 in 2024.SEP-IRA and Profit Sharing:The annual contribution limit increases from $66,000 in 2023 to $69,000 in 2024.Why are these changes important?These increases in contribution limits allow you to save more money for your future and potentially achieve your retirement goals faster. We encourage you to review your…

Opportunities abound in the markets, even during periods when the economy appears ripe for a regime shift. Recent growth metrics surprised to the upside, but leading indicators point toward some downside risk. In this edition of the Weekly Market Commentary, we examine potential opportunities amid a rotation in housing, buying patterns, and inflation.Inflation trajectory is favorable for risk assetsHeadline inflation in October was unchanged month over month, pulling the annual rate down to 3.0% from 3.4%. Markets often focus on the core services rate of inflation excluding housing, and that important category decelerated to under 4% for the first time since March 2021 (Figure 1). The improving environment likely encouraged Christopher Waller, a Federal Reserve (Fed) Governor, to suggest the Fed could hold rates steady at the upcoming meeting. Waller had been the most hawkish of the Fed officials, so this was a market-moving statement. Treasury yields and the U.S. dollar fell on the news. Some pundits argue the economy could experience a resurgence in inflation, but the resurgence narrative is misguided. In general, inflation is cooling, and markets could end up pleasantly surprised as inflation could cool faster than expected. Investors should expect additional Fed officials to tweak their language as they…

There is nothing like an eight-day winning streak to change the market narrative. Stocks have quickly gone from a correction to a comeback this month, and the S&P 500 is now challenging key resistance at 4,400. While a confirmed breakout above this level raises the odds of the correction being over, there are still a few boxes left to check on our technical list before making that call. One of the unchecked items is market breadth. Despite the recent rally, participation in the latest rebound has been underwhelming, raising questions over the sustainability of the advance. Second, 10-year Treasury yields remain in an uptrend, and until more technical evidence confirms the highs have been set, it may be challenging for stocks to maintain their upside momentum.From a Correction to a ComebackThe S&P 500 officially entered correction territory in late October after falling over 10% from its summer high. Rising interest rates and a steady drumbeat of higher-for-longer monetary policy messaging from the Federal Reserve (Fed) captured most of the blame for the selling pressure. The unexpected Israel-Hamas war, weak seasonal trends, and sputtering economic activity in China also weighed on risk appetite.As shown in Figure 1, the pullback created a wave…

Despite headwinds, the U.S. could experience structural changes in the labor market, residential real estate, and inflation as the post-pandemic economy progresses into the New Year. As markets adjust to a new regime, investors should recognize the economy is becoming less interest rate sensitive and they should focus on leading indicators such as the ratio of part-time workers and not on lagging metrics such as the headline growth stats mostly cited in the media.Setting Up for a ‘Eucatastrophe’J.R.R. Tolkien, author of the Lord of the Rings and famous member of The Inklings at Oxford University during the 1940s, coined a word—eu·ca·tas·tro·phe—to describe an event that turns out surprisingly better than expected. Frodo’s defeat sets up for an unpredictably successful conclusion.One could argue that the post-pandemic economy had a few moments when things turned out better than expected. The economy grew faster than expected in recent quarters, unemployment remained historically low, and some sectors such as homebuilders have boosted activity despite the macro headwinds. The tight labor market seems to be a boon for workers, and one could argue that workers have never been in a better position to bargain for better pay and more benefits, but more on that later…

In our latest Capital Planning Staff Spotlight, we caught up with Partner and Financial Advisor Jonathan Carpenter, CFP®, RICP®. While we all know Jonathan pretty well, it was a great opportunity to learn a few things - including what he loves to eat, why laundry is his weakness, and about his appreciation for an upcoming holiday. Read on to find out more! What’s your favorite food? Egg Sandwiches! I could eat an egg sandwich for breakfast, lunch, or dinner. It’s not uncommon in the Carpenter household to even have an egg sandwich for a midnight snack. Add a little American cheese, and sausage, and you created a delicate food item that is better than a wagyu steak. Just saying! What’s your least favorite chore around the house? Hands down, folding laundry! Raising 3 young boys who dirty their outfits every two seconds creates a lot of laundry, resulting in a lot of folding. It’s a daunting task trying to match bundles of socks, and remembering what pajamas belong to which son. However, I’m blessed with an amazing wife who makes time to handle this chore for our family. What’s your favorite holiday? Thanksgiving! We have been getting together with my…

Planning for an unpredictable future can feel overwhelming, with so many decisions to make it can be hard to know if you're going to have enough money to support yourself through retirement.

In this guide, experts from the Capital Planning Team have simplified the 10 steps you can take, so that you can live a life without worry, sfe in the knowledge that your financial future is secure.