Opportunities abound in the markets, even during periods when the economy appears ripe for a regime shift. Recent growth metrics surprised to the upside, but leading indicators point toward some downside risk. In this edition of the Weekly Market Commentary, we examine potential opportunities amid a rotation in housing, buying patterns, and inflation.

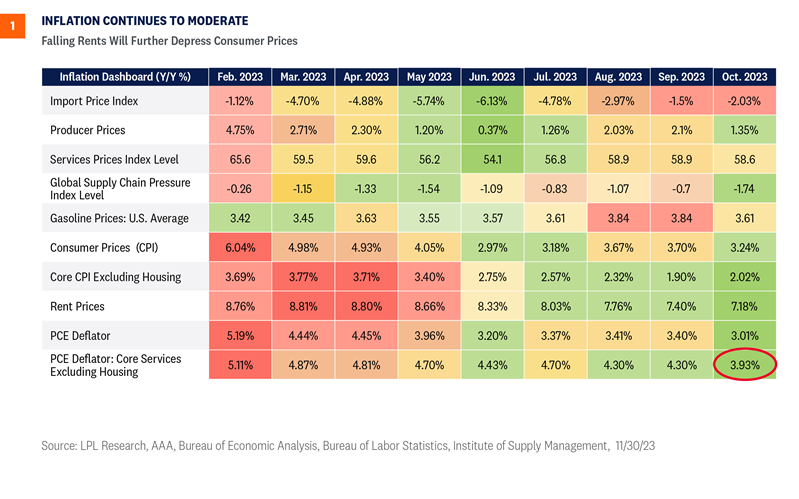

Headline inflation in October was unchanged month over month, pulling the annual rate down to 3.0% from 3.4%. Markets often focus on the core services rate of inflation excluding housing, and that important category decelerated to under 4% for the first time since March 2021 (Figure 1). The improving environment likely encouraged Christopher Waller, a Federal Reserve (Fed) Governor, to suggest the Fed could hold rates steady at the upcoming meeting. Waller had been the most hawkish of the Fed officials, so this was a market-moving statement. Treasury yields and the U.S. dollar fell on the news.

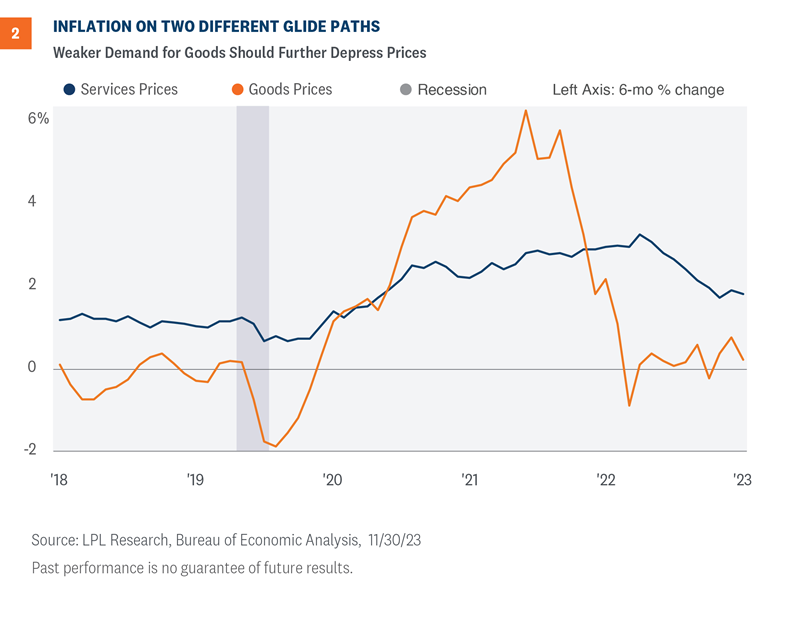

The economy is in a period of flux as illustrated in the inflation data. October prices for goods decreased 0.3% from a month ago, whereas prices for services increased 0.2% over the month. Goods prices likely declined as consumer demand waned, especially for durable goods. However, consumer demand was strong for international travel, food services, and accommodations (Figure 2).

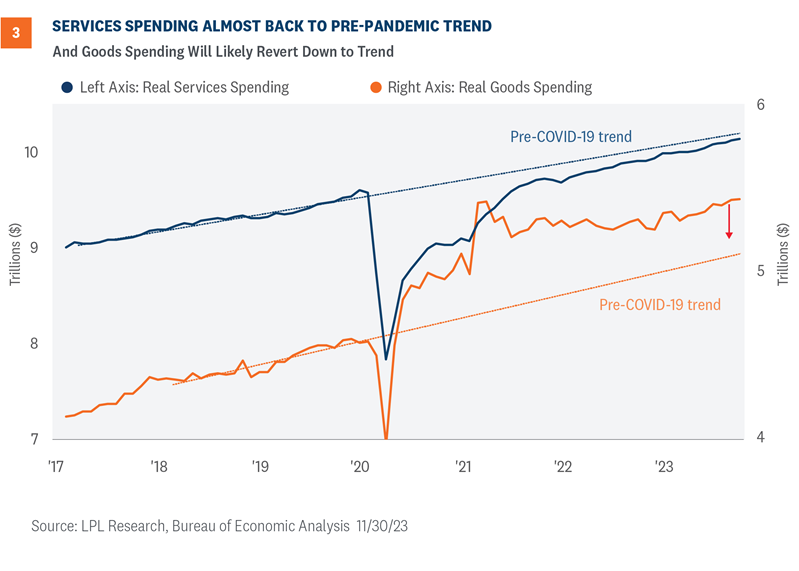

If consumers return to normal spending patterns, we should see a modest deceleration in the rate of spending as consumers recalibrate. Investors should watch the consumer discretionary space as shoppers rotate the composition of spending.

The November Beige Book, an important compilation of business insights from across the country, hinted at the potential for a new regime that may provide opportunities for savvy investors. Many districts indicated a softening in consumer spending as shoppers searched for discounts. Several areas of the country reported declines in starting wages for unskilled workers, a sign that we have likely seen a shift in overall labor demand. However, businesses are still paying a premium to attract and retain talent. Banks saw a slight uptick in consumer delinquencies, a theme corroborated by other public reports and a leading indicator for a change in consumer spending (Figure 3).

The anecdotal evidence suggests the Fed is getting what it wished for—an economy experiencing a painless, measured slowdown. As pricing pressures will likely ease further in the months ahead, markets can reasonably expect the Fed to pause until the middle of next year when they could modestly cut rates. Overall, the Beige Book was supportive for investors looking to take on more risk.

Consumers are contending with a confounding housing market. This may provide some opportunities for home builders to meet demand. The scarce supply of existing homes is pushing buyers to the new home market, benefitting homebuilders.

One of the puzzling experiences for consumers these days is within the housing market. Prospective buyers are reading the tale of two markets when it comes to residential real estate. After a volatile 2022, the pace of new home sales has stabilized around the pre-pandemic rate as new home prices moderate and homebuilders get creative with in-house financing to entice buyers. New home prices are down over 17% from a year ago.

Not so with the existing home market. Investors have not seen much recovery in the existing home market. With supply of existing homes still below 50% of its pre-pandemic level, new homebuilders stand ready to take advantage of any increase in demand. Currently, activity is strongest in the Midwest and West, with supply chain issues and inclement weather negatively affecting builds in the Northeast.

Amid low inventory of existing homes on the market, new home sales will likely remain stable to meet the demand. As mortgage rates fall and the Fed pivots away from hiking rates, homebuilders might expect continued growth in business activity. As we saw in the holiday sales figures, the consumer is still spending, but much depends on the job market. All eyes should be on the jobs report on December 8. As the labor market cools, investors should expect consumer spending to slow down, but so far, it looks like a soft landing. All in all, the data supports the Fed’s likely decision to keep rates unchanged at next month’s meeting.

The Fed could find themselves in a sweet spot. Inflation is trending lower, the consumer is still spending but at a slower pace, and the Fed could end its rate-hiking campaign without much pain inflicted on the economy. Looking ahead, markets will focus on anecdotal evidence on the state of the economy, but so far, the economic data are suppressing yields and stimulating the appetite for risk assets.

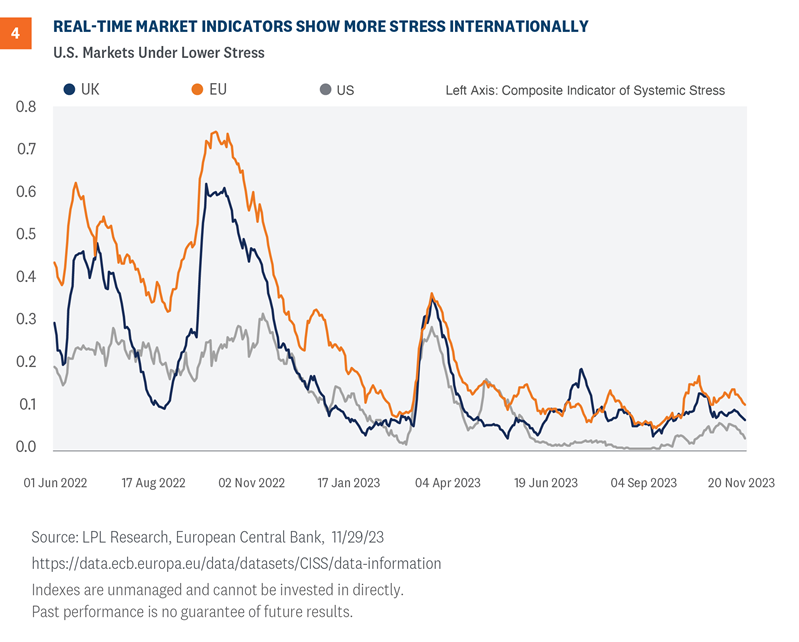

One additional item to watch is the U.S. dollar. As the Fed started to sound less hawkish, investors saw a decline in the dollar. A weaker dollar is often good for emerging markets, potentially providing an opportunity in the near future. LPL Research currently holds a negative view of emerging market equities but acknowledges valuations are attractive and that certain markets such as India and Brazil are intriguing. Domestic markets are relatively more attractive given the lower stress, but the improvement in real-time market stress indicators bodes well for long term investors.1 As indicated in Figure 4, the U.S. markets have less financial stress than the E.U. or the U.K., but that is typical given the historical data. This indicator from the European Central Bank (ECB) is insightful as investors gauge financial conditions across countries.

After the last few weeks of softening economic data, it increasingly looks like the July rate hike will be the last one for this cycle, and that could be good news for fixed income investors. Historically, once the Fed is done raising interest rates, we tend to see lower yields on intermediate-term securities even before the Fed actually cuts rates. Of the most recent Fed rate hiking campaigns, 10-year Treasury yields were lower, on average, by 1% a year after the Fed stopped raising rates.

So, if history at least rhymes during this cycle and we do see lower yields over the next year, intermediate core bonds could very well outperform cash and other shorter maturity fixed income strategies. Historically, core bonds, as proxied by the Bloomberg Aggregate Bond Index, have performed well during Fed pauses. Since 1984, core bonds were able to generate average six-month and one-year returns of 8% and 13%, respectively, after the Fed stopped raising rates. Moreover, all periods generated positive returns over the six-month, one-year, and three-year horizons.

LPL’s Strategic and Tactical Asset Allocation Committee (STAAC) recommends a neutral tactical allocation to equities, with a modest overweight to fixed income funded from cash. The risk-reward trade-off between stocks and bonds looks relatively balanced to us, with core bonds providing a yield advantage over cash.

The STAAC recommends large cap growth style equities over their large cap value counterparts. The STAAC believes that growth style large-cap equities may benefit from lower inflation and stabilization of interest rates in the intermediate term. Growth stocks may also benefit from superior earnings prospects against a backdrop of a slowing economy.

The STAAC recently upgraded its view on the communication services equity sector, moving to overweight based on supportive valuations, strong earnings growth, and favorable technical analysis trends.

In conjunction with that move, the STAAC also downgraded the industrials equity sector to neutral based on slowing capital investment activity and a technical backdrop no longer commensurate with an overweight view.

Communication services and energy are now the Committee’s top sector picks.

Within fixed income, the STAAC recommends an up-in-quality approach with benchmark-level interest rate sensitivity. We think core bond sectors (U.S. Treasuries, agency mortgage-backed securities (MBS), and short-to-intermediate maturity investment grade corporates) are currently more attractive than plus sectors (high-yield bonds and non-U.S. sectors) with the exception of preferred securities, which look attractive after having sold off this spring due to stresses in the banking system.

Jeffrey Roach, PhD, Chief Economist

Lawrence Gillum, CFA, Chief Fixed Income Strategist

IMPORTANT DISCLOSURES

This material is for general information only and is not intended to provide specific advice or recommendations for any individual. There is no assurance that the views or strategies discussed are suitable for all investors or will yield positive outcomes. Investing involves risks including possible loss of principal. Any economic forecasts set forth may not develop as predicted and are subject to change.

References to markets, asset classes, and sectors are generally regarding the corresponding market index. Indexes are unmanaged statistical composites and cannot be invested into directly. Index performance is not indicative of the performance of any investment and do not reflect fees, expenses, or sales charges. All performance referenced is historical and is no guarantee of future results.

Any company names noted herein are for educational purposes only and not an indication of trading intent or a solicitation of their products or services. LPL Financial doesn’t provide research on individual equities.

All information is believed to be from reliable sources; however, LPL Financial makes no representation as to its completeness or accuracy.

US Treasuries may be considered “safe haven” investments but do carry some degree of risk including interest rate, credit, and market risk. Bonds are subject to market and interest rate risk if sold prior to maturity. Bond values will decline as interest rates rise and bonds are subject to availability and change in price.

The Standard & Poor’s 500 Index (S&P500) is a capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

The PE ratio (price-to-earnings ratio) is a measure of the price paid for a share relative to the annual net income or profit earned by the firm per share. It is a financial ratio used for valuation: a higher PE ratio means that investors are paying more for each unit of net income, so the stock is more expensive compared to one with lower PE ratio.

Earnings per share (EPS) is the portion of a company’s profit allocated to each outstanding share of common stock. EPS serves as an indicator of a company’s profitability. Earnings per share is generally considered to be the single most important variable in determining a share’s price. It is also a major component used to calculate the price-to-earnings valuation ratio.

All index data from FactSet.

Value investments can perform differently from the market as a whole. They can remain undervalued by the market for long periods of time.

The prices of small cap stocks are generally more volatile than large cap stocks.

International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors. These risks are often heightened for investments in emerging markets.

LPL Financial does not provide investment banking services and does not engage in initial public offerings or merger and acquisition activities.

For a list of descriptions of the indexes and economic terms referenced in this publication, please visit our website at lplresearch.com/definitions.

This research material has been prepared by LPL Financial LLC.

Securities and advisory services offered through LPL Financial (LPL), a registered inv estment advisor and broker -dealer (member FINRA/SIPC). Insurance products are offered through LPL or its licensed affiliates. To the extent you are receiving investment a dvice from a separately registered independent investment advisor that is not an LPL affiliate, please note LPL makes no representation with respect to such entity.

| Not Insured by FDIC/NCUA or Any Other Government Agency | Not Bank/Credit Union Guaranteed | Not Bank/Credit Union Deposits or Obligations | May Lose Value |

RES-000347-1123 | For Public Use | Tracking #511849 (Exp. 12/2024)

Many people are curious to understand the potential tax benefits available to them. Questions such as “Is a 529 plan right for me and my goals?” are common, and at Capital Planning, we’ll be happy to guide you on this and any other questions you have.

We can work with you to conduct an analysis of funding needs, and provide recommendations as to investment allocation, ultimately helping you to select the right investments for your goals.

Book a discovery meeting today and speak with one of our advisors about independent financial planning with purpose, so you can focus on enjoying life.