We can’t look back in history without seeing eras marked by war and conflict. With the onset of the war in the Middle East, geopolitical concerns have broadened from the ongoing Russia/Ukraine conflict and implications for a wider confrontation along the NATO border. The recent military threat imposed by Hamas has also brought the Middle East back into the spotlight, with questions around how long the Israeli/Hamas conflict will last. From an investment standpoint, any geopolitical tension has the potential to affect the markets. There’s also an impact on commodities, meaning we’ll want to keep a closer eye on those asset classes producing goods in these regions of conflict.

Despite rising tensions and uncertainty across the globe, investors should keep a long-term orientation and favor a well-diversified portfolio. We believe that diversification across sectors, regions, and asset classes can help investors hedge against and make the most of volatile markets.

TECHNOLOGY’S ROLE IN U.S.-CHINA RELATIONS

Despite attempts to foster deeper commercial ties, the U.S. has two goals dominating its relations with China. The first goal is keeping China from acquiring advanced semiconductor technology that can be applied to its expanding military buildup. The second is establishing a U.S. domestic semiconductor supply chain infrastructure. Protectionism, vis-à-vis advanced semiconductor technology, enjoys bipartisan support in the U.S. as national security threats receive heightened attention.

High-level U.S. government bilateral visits to Beijing have kept a dialogue active, but increasingly, the relationship has been reduced to concerns over Beijing’s determination to bring Taiwan into the “One China” orbit, with force, if necessary.

So, what’s China’s reaction been to these export controls? Acrimony. China has attempted to limit sales of Apple products within government sponsored offices, as they have been deemed a security threat. At the same time, Huawei has re-emerged, raising questions as to how they secured the technology to introduce “smart” products. Huawei is the sanctioned global telecommunication giant that was accused of spying on behalf of China’s military. With all of this going on, it’s not surprising that Apple’s iPhone 15 sales have edged lower in their prime China market, while Huawei smartphone sales have galloped higher.

IMPACT ON OIL

China’s economy is still not fully recovered from the nearly three years of COVID-19-related lockdowns and property developers mired in heavy debt burdens. As a result, Beijing has responded with a limited patchwork of targeted monetary stimulus measures, which have done little to bolster a stronger economic response.

China’s lackluster reopening likely has kept oil price gains somewhat suppressed in 2023 (China is the world’s largest importer of oil). Fears of recession outside of the U.S. and rising global supply have further weighed on oil. To combat the supply and demand imbalance, OPEC+ has been actively ‘managing’ the supply side of the equation through extended production cuts, although their efficacy is being offset by a boom in U.S. oil production.

With renewed expectations that the Chinese economy could be supported by a broad fiscal package, coupled with forecasts that global central banks have for the most part completed their respective rate-hiking campaigns, the economic backdrop should remain constructive for oil demand.

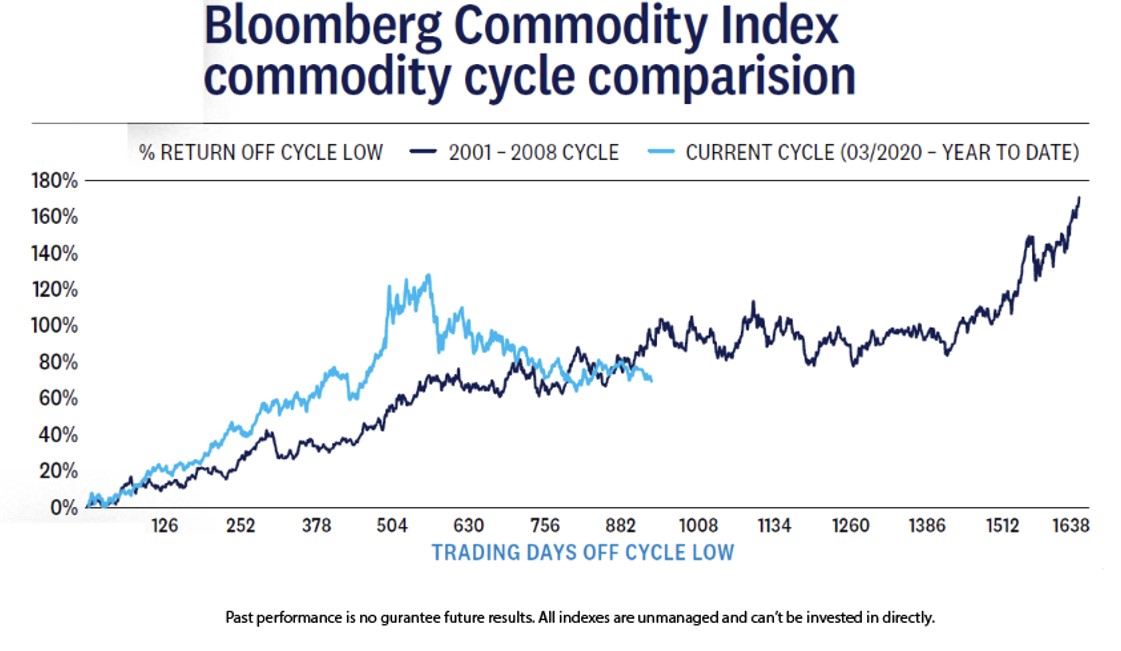

THE BROADER WORLD OF COMMODITIES

Broadly speaking, the commodity complex of industrial metals—except for iron ore— has remained muted, as the sector waits for the possibility of a more aggressive fiscal package most likely targeted for infrastructure spending. This could help propel prices within a broad swath of metals.

China has made electric vehicle (EV) production a top priority, leading to significant price increases in metals used for battery production, such as lithium. Copper, used globally in renewable energy systems, should benefit as the global economy seeks to finance large-scale projects.

Precious metals, especially gold, have also seen prices rise, which is an indication that investors are looking for safe havens. Hedging for geopolitical and currency risk, global central banks have been large buyers of gold—the People’s Bank of China has been one of the largest buyers of gold over the last couple of years. If the markets continue to consider the geopolitical risks, precious metals will garner further support in 2024.

THE DOLLAR STRIKES BACK:

The dollar made a strong comeback against a basket of foreign currencies in the second half of 2023. This about-face in sentiment was driven primarily by interest rate differences and domestic economic growth, which moved sharply back in the dollar’s favor. Capital will usually go where it is treated best, and global capital was enticed back to the U.S. on clearer prospects of economic growth and higher rates of return on USD-denominated investments.

The dollar remains quite overvalued on a historical and relative basis, meaning there is likely going to be value in holding foreign denominated assets in the longer term. Even though we’re seeing currencies like the yen, euro, and British pound weaken to attractive levels, valuation extremes can take a long time to correct in currencies. Until markets see more synchronized global economic growth and/or foreign central bank led policy shifts toward higher rates, foreign currencies will likely struggle to meaningfully outpace the dollar.

The yen is the worst performing developed market currency over the last year, and on some valuation metrics it is at 50-year lows. The weakness in the currency can mostly be attributed to a lack of action from the Japanese central bank. Despite domestic inflation reaching the highest level in 40 years, the BOJ has refused to meaningfully move away from an ultra-loose policy framework. This inaction has been contrary to market expectations. A move by the central bank to appease the markets by raising interest rates in 2024 would be very positive for the currency and likely have important ramifications across markets.

The ECB’s aggressive interest rate-hiking campaign and China’s slow recovery from lockdown, have put the European economy under pressure (as China is Europe’s main trading partner in goods). Germany, France, and a few members on the periphery are now all at risk of entering recession in 2024. Not surprisingly, this weighed heavily on the euro in the second half of 2023. Despite this deteriorating economic outlook, the ECB has remained steadfast in its assertion that official rates will remain at high levels for “a sufficiently long duration.” Barring an unexpected resurgence in European economic growth, the clear risk for the euro heading into 2024 is that the ECB will be forced to aggressively reverse its current stance to avoid a potential policy error.

The opinions, statements and forecasts presented herein are general information only and are not intended to provide specific investment advice or recommendations for any individual. It does not take into account the specific investment objectives, tax and financial condition, or particular needs of any specific person. There is no assurance that the strategies or techniques discussed are suitable for all investors or will be successful. To determine which investment(s) may be appropriate for you, please consult your financial professional prior to investing. Any forward-looking statements including the economic forecasts herein may not develop as predicted and are subject to change based on future market and other conditions. All performance referenced is historical and is no guarantee of future results.

References to markets, asset classes, and sectors are generally regarding the corresponding market index. Indexes are unmanaged statistical composites and cannot be invested into directly. Index performance is not indicative of the performance of any investment and does not reflect fees, expenses, or sales charges. All performance referenced is historical and is no guarantee of future results. Alternative investments may not be suitable for all investors and should be considered as an investment for the risk capital portion of the investor’s portfolio. The strategies employed in the management of alternative investments may accelerate the velocity of potential losses. Event driven strategies, such as merger arbitrage, consist of buying shares of the target company in a proposed merger and fully or partially hedging the exposure to the acquirer by shorting the stock of the acquiring company or other means. This strategy involves significant risk as events may not occur as planned and disruptions to a planned merger may result in significant loss to a hedged position. Any company names noted herein are for educational purposes only and not an indication of trading intent or a solicitation of their products or services. LPL Financial doesn’t provide research on individual equities. All index data from FactSet. All information is believed to be from reliable sources; however, LPL Financial makes no representation as to its completeness or accuracy.

GENERAL RISK DISCLOSURES

Investing involves risks including possible loss of principal. No investment strategy or risk management technique can guarantee return or eliminate risk in all market environments. There is no guarantee that a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not protect against market risk. Investing in foreign and emerging markets debt or securities involves special additional risks. These risks include, but are not limited to, currency risk, geopolitical risk, and risk associated with varying accounting standards. Investing in emerging markets may accentuate these risks.

Many people are curious to understand the potential tax benefits available to them. Questions such as “Is a 529 plan right for me and my goals?” are common, and at Capital Planning, we’ll be happy to guide you on this and any other questions you have.

We can work with you to conduct an analysis of funding needs, and provide recommendations as to investment allocation, ultimately helping you to select the right investments for your goals.

Book a discovery meeting today and speak with one of our advisors about independent financial planning with purpose, so you can focus on enjoying life.