Wall Street narratives can change relatively quickly as investors translate new information into speculation over future events. One of the widely publicized narratives at the beginning of the year was the ‘Goldilocks’ economy. This theme was used to describe an ideal economic state, where inflation is not too hot and growth is not too cold, analogous to the porridge that was “just right” in the popular Goldilocks and the Three Bears children’s story. Stocks tend to do well against this backdrop, evidenced by the S&P 500’s 10.2% price gain in the first quarter — a rally that also included 22 record highs and a maximum drawdown of only 1.7%.

On Main Street, narratives often change with the seasons. I was reminded of this when watching snowfall quickly turn into rain during a volatile week of weather in the Midwest. Inevitably, as the narrative goes, April showers bring May flowers, at least that is the hope. With markets, hotter-than-expected inflation data underpinned a volatile few weeks of price action and delivered the proverbial April showers, driving the S&P 500 down 5.5% this month, as of April 19.

Akin to spring, there is also hope for May flowers blooming in the form of a market rebound. However, the timing and likelihood of a recovery in stocks could largely be predicated on how the market handles incoming inflation data, including the upcoming personal consumption expenditures (PCE) report on Friday — the Federal Reserve’s (Fed) preferred measure of inflation. Another upside inflation surprise would feed right into the market’s recently rejuvenated “higher for longer” narrative, underpinned by rising expectations for the Fed to keep interest rates elevated for a prolonged period (and by default, reduced expectations for interest rate cuts).

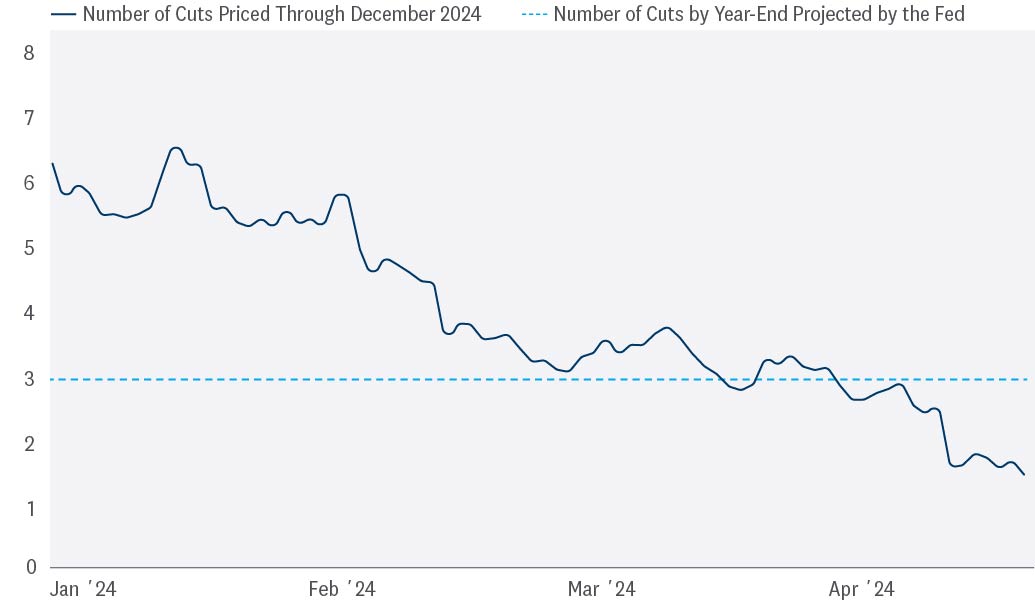

The chart below highlights how the market has shifted toward the higher-for-longer monetary policy outlook. At the start of the year, fed funds futures forecasted six or seven rate cuts by year-end, expectations LPL Research considered too high at the time. Resilient economic data, especially in the labor market, coupled with three straight months of hotter-than-expected consumer inflation data significantly reduced rate cut estimates to one or maybe two by year-end (odds for a second cut are running near 50%). You may also notice how the market has now become less dovish than even the Fed, which forecasted three rate cuts during its March policy meeting.

Source: LPL Research, Bloomberg 04/18/24

Past performance is no guarantee of future results.

Treasury yields are inversely related to rate cut expectations. As the market repriced the probability of the Fed keeping things on hold for longer than originally anticipated, yields jumped higher across the curve. The closely watched 10-year Treasury yield surged over 40 basis points this month to around 4.60%, a far cry from the 3.88% starting point of the year. Technically, yields have also broken out above key resistance near 4.35%, a level tracing back to the October 2022 highs and a tipping point for risk appetite last summer. And while today’s price action shares some parallels to then — surging Treasury yields contributed to selling pressure in an overbought equity market — stocks have thus far absorbed the recent jump in rates much better. This is demonstrated by a less negative correlation between the S&P 500 and 10-year Treasury yields between now and then, suggesting markets may be a little more comfortable in the economy handling higher rates this time around.

All indexes are unmanaged and cannot be invested in directly. Past performance is no guarantee of future results.

There is also some relatively good news embedded in the jump in yields, as most of the increase can be attributed to growth expectations outpacing inflation expectations, assuaging some fears over stagflation. The other good news is that the current backup in rates provides opportunities for investors to lock in high-quality fixed income yields at attractive levels. As a reminder, LPL Research continues to recommend a modest overweight to fixed income, funded from cash.

Overbought conditions often leave investors searching for reasons why the market needs to sell-off. The shift to higher-for-longer monetary policy serves as a compelling excuse for reduced risk appetite, especially when paired with hot inflation data, hawkish Fedspeak, surging yields, and headlines of a war escalating further in the Middle East. Technically, the S&P 500 has pulled back through a shorter-term uptrend and violated its 20- and 50-day moving averages (dma). Oversold conditions have subsequently developed, evidenced by over half of the index registering new four-week lows last week. Historically, crossovers above the 50% threshold have often been found at relief rally inflection points, especially when the market is holding above its longer-term trend. Regarding downside risk, a correction (technically, at least a 10% drawdown, but not beyond 20%) is not out of the cards — and completely normal within a bull market. However, from a technical perspective, we continue to view 4,800 as a worst-case scenario for the S&P 500. Confidence for a relatively shallow drawdown is supported by no change in leadership away from cyclical/offensive sectors, bullish market breadth that is holding up relatively well, longer-term momentum implications of this rally, historically tight credit conditions, and resilient economic data.

Source: LPL Research, Bloomberg 04/18/24

All indexes are unmanaged and cannot be invested in directly. Past performance is no guarantee of future results.

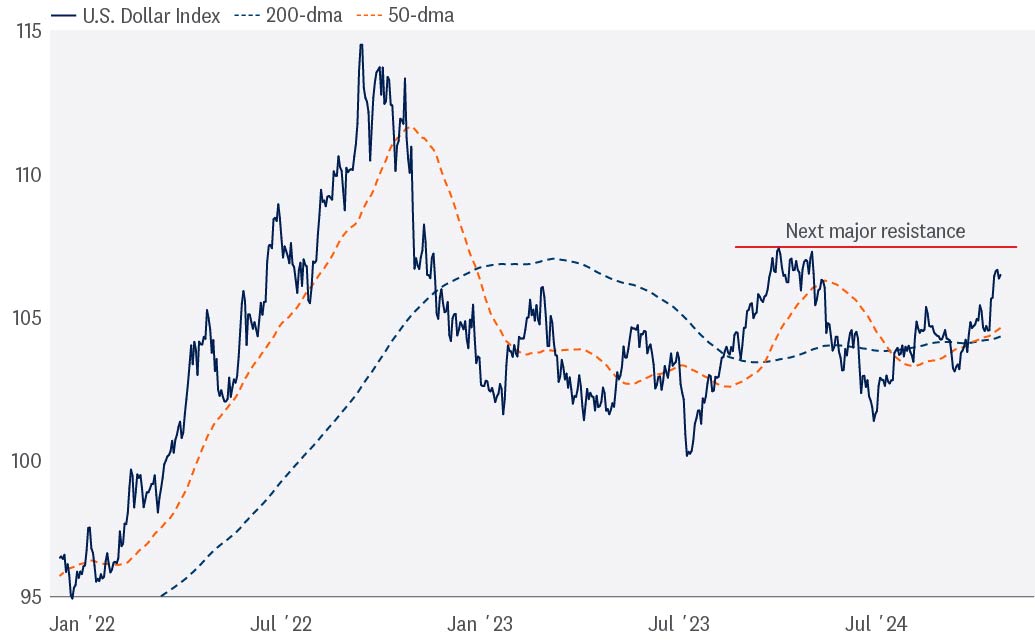

The U.S. dollar has rerated higher amid the shift toward higher-for-longer monetary policy. Momentum in the greenback suggests a retest of the 2023 highs could be underway. And while a stronger dollar creates headwinds for U.S. multinational companies generating revenues abroad, it can also create headaches for other central banks.

In currency markets, it is always a relative game, and a stronger dollar equates to a cheaper currency abroad. When other foreign currencies become too cheap, central banks sometimes have to intervene and prop up their own currencies. This can be costly, detract from hard dollar currency reserves, and if not managed properly, weigh on credit risk as it could materially impact a country’s ability to service its dollar-denominated debt. Emerging markets are often a victim of a stronger dollar and more recently, the People’s Bank of China (PBOC) has struggled to maintain yuan stability against the dollar, forcing it to weaken its daily reference rate. China is also not only export-driven but is also tasked with trying to stimulate its struggling economy, leaving aggressive tightening as a problematic option for the PBOC. The Bank of Japan (BOJ) is also struggling with a weaker yen, prompting speculation for forced intervention and/or a potential earlier-than-expected rate hike.

Source: LPL Research, Bloomberg 04/18/24

All indexes are unmanaged and cannot be invested in directly. Past performance is no guarantee of future results.

The shift toward higher-for-longer monetary policy has contributed to recent selling pressure in an overbought equity market. Treasury yields have rerated higher, but the increase can be attributed more to growth expectations outpacing inflation expectations. We also view the backup in rates as an opportunity for investors to lock in elevated high-quality fixed income yields. Dollar dominance has been another derivative of the higher-for-longer narrative, creating currency stability risk, especially for emerging markets.

Finally, it is important to remember pullbacks and even corrections are completely normal within a bull market. They provide an opportunity for fundamentals to catch up with price, reset overbought conditions, suppress overly exuberant sentiment, and provide another potential entry point into this bull market.

Many people are curious to understand the potential tax benefits available to them. Questions such as “Is a 529 plan right for me and my goals?” are common, and at Capital Planning, we’ll be happy to guide you on this and any other questions you have.

We can work with you to conduct an analysis of funding needs, and provide recommendations as to investment allocation, ultimately helping you to select the right investments for your goals.

Book a discovery meeting today and speak with one of our advisors about independent financial planning with purpose, so you can focus on enjoying life.