After a relatively slow start, the S&P 500 rallied during the back half of January and closed out the month with a gain of 1.6%. Buying pressure was relatively narrow, as declining shares on the index modestly outpaced advancers. Similar to 2023, a few mega-caps did most of the heavy lifting. Shares of NVIDIA (NVDA), Microsoft (MSFT), and Meta (META) contributed 80% of the S&P 500’s total return during the month.

From a historical perspective, a positive January has been a bullish sign for stocks. Yale Hirsch, creator of the Stock Trader’s Almanac, first discovered this seasonal pattern back in 1972, which he called the January Barometer and coined its popular tagline of ‘As goes January, so goes this year.’

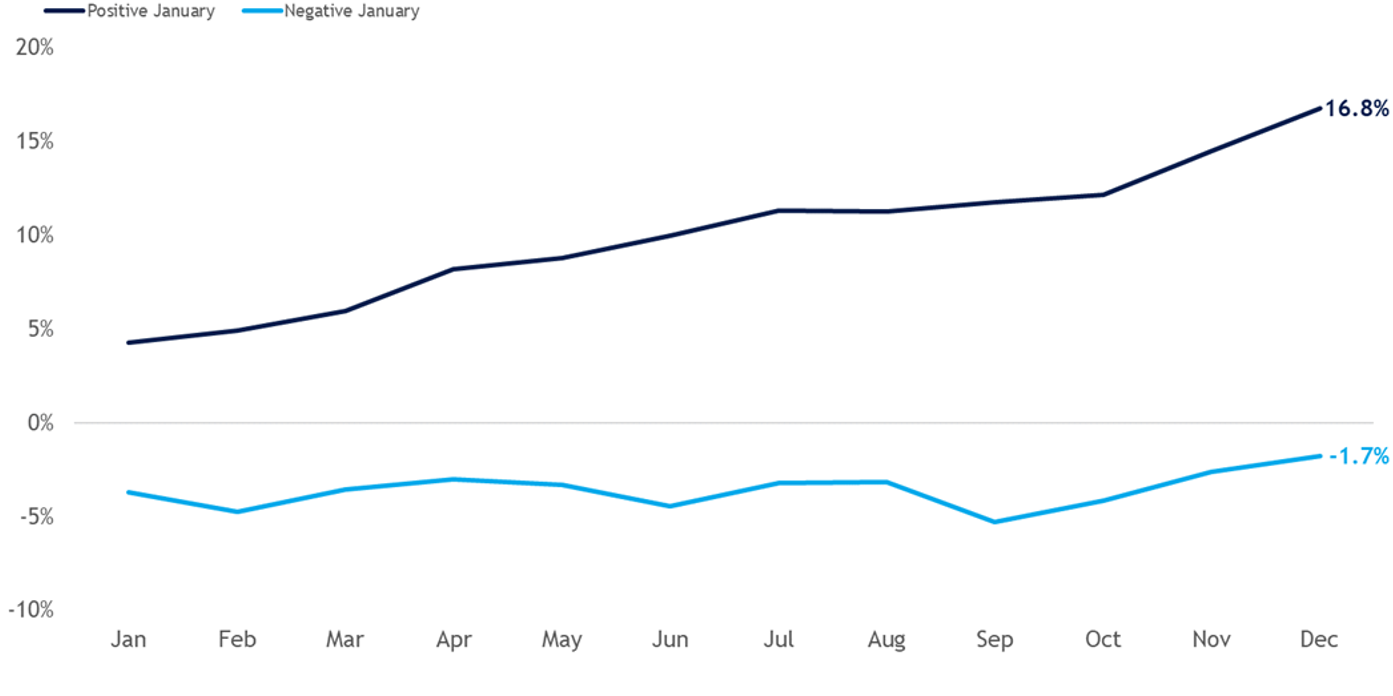

As highlighted in the chart below, the popular Wall Street maxim has stood the test of time. Since 1950, the S&P 500 has posted an average annual return of 16.8% during years that included a positive January. Furthermore, the index generated positive returns during these years 89% of the time. In contrast, when the index traded lower in January, annual returns dropped to -1.7%, with only 50% of occurrences yielding positive results.

S&P 500 January Barometer (1950–2023)

Source: LPL Research, Bloomberg 02/01/24

Disclosures: Past performance is no guarantee of future results. All indexes are unmanaged and can’t be invested in directly. The modern design of the S&P 500 stock index was first launched in 1957. Performance back to 1950 incorporates the performance of the predecessor index, the S&P 90.

U.S. equity markets have shrugged off a slow start to 2024 and rallied to record highs. The prospect for a soft landing, falling inflation, and a shift from rate hikes to rate cuts has helped offset an underwhelming fourth quarter earnings season thus far. Despite shorter-term overbought conditions, the technical backdrop for the broader market remains bullish, further supported by a positive January Barometer signal that suggests the path of least resistance for stocks remains higher.

IMPORTANT DISCLOSURES

This material is for general information only and is not intended to provide specific advice or recommendations for any individual. There is no assurance that the views or strategies discussed are suitable for all investors. To determine which investment(s) may be appropriate for you, please consult your financial professional prior to investing.

Investing involves risks including possible loss of principal. No investment strategy or risk management technique can guarantee return or eliminate risk.

Indexes are unmanaged and cannot be invested into directly. Index performance is not indicative of the performance of any investment and does not reflect fees, expenses, or sales charges.All performance referenced is historical and is no guarantee of future results.

For Public Use – Tracking: #536027

Many people are curious to understand the potential tax benefits available to them. Questions such as “Is a 529 plan right for me and my goals?” are common, and at Capital Planning, we’ll be happy to guide you on this and any other questions you have.

We can work with you to conduct an analysis of funding needs, and provide recommendations as to investment allocation, ultimately helping you to select the right investments for your goals.

Book a discovery meeting today and speak with one of our advisors about independent financial planning with purpose, so you can focus on enjoying life.