A 2024 Midyear Outlook

With the midpoint of 2024 here, we are taking a look back at the start of the year while simultaneously looking ahead to what’s on the horizon. Over the next few weeks, we will be offering fresh insights into the economic and market landscape. This includes important topics such as the economy, the stock market, the bond market, geopolitics, the election, and more.

This week, we kick things off with an economy review.

We Have a Delayed Landing, But Still a Landing

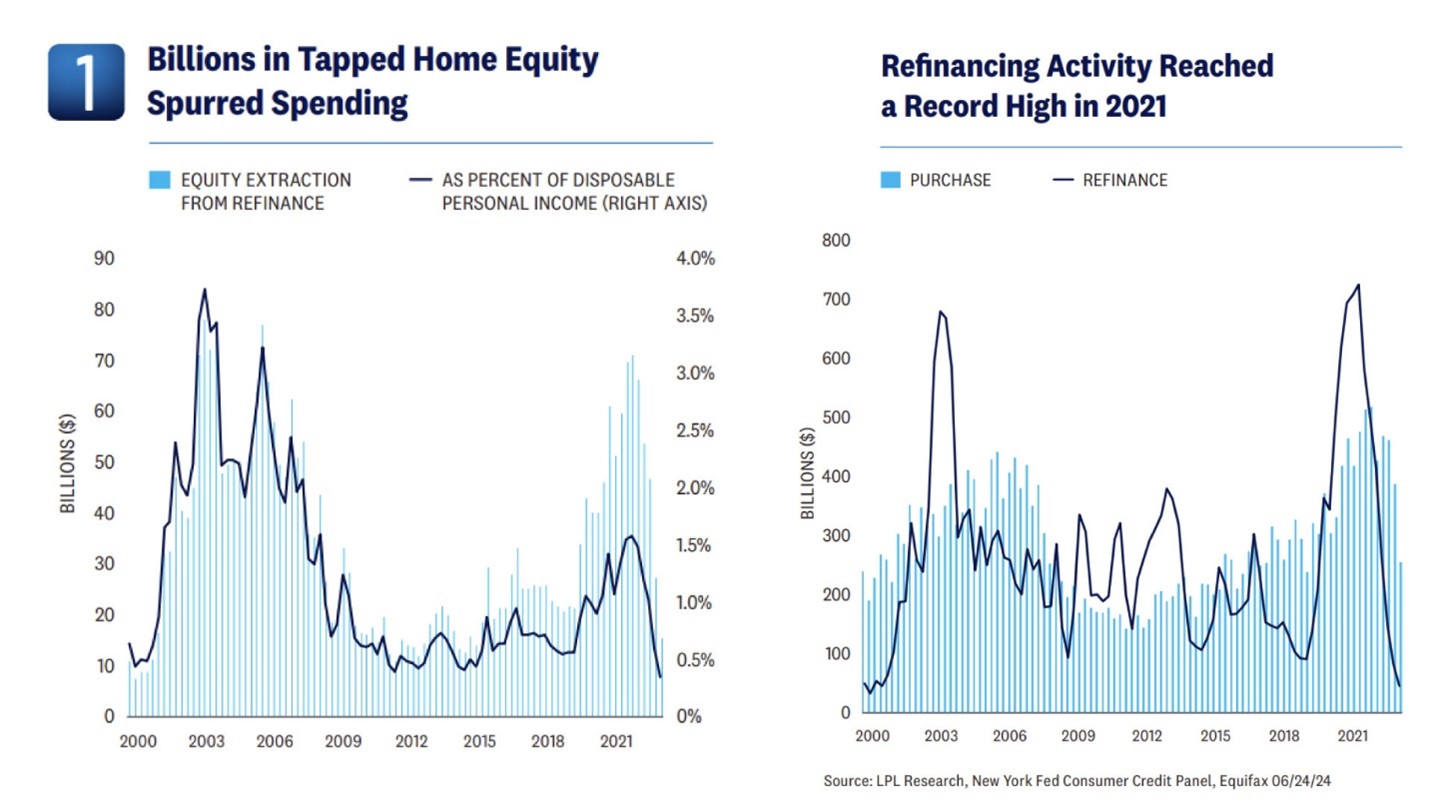

Recent data on refinancing activity provides a clue on why the economy has experienced a delayed landing. The housing market often explains a lot of what is happening in other sectors of the economy, and this time is no different. Roughly one-third of mortgages were refinanced in the quarters following the pandemic recession of 2020.¹ And because of 2020’s extremely low mortgage rates, these homeowners lowered their monthly payments, thereby increasing their disposable income. Other homeowners took advantage of healthy home equity and took cash out to support more spending. The incredible impact of such historic refinancing activity caught many, including us, by surprise. In addition to the oft-mentioned excess savings from stimulus and temporarily curtailed spending, improved household financial conditions from low mortgage rates kept the economy out of the doldrums.

As we look ahead, however, the domestic economy looks to be late cycle, and recent data suggests the consumer has started to slow down. We indeed expect the consumer will slow spending later this year as data from both the Conference Board and the University of Michigan revealed that most consumers have pivoted away from big-ticket buying plans. These changes in buying plans could have knock-on effects in other categories of spending. Investors should anticipate a forthcoming downshift in consumer activity [Fig 1].

A Less Rate-Sensitive Economy Causing Some of the Delays

One of the Fed’s monetary tools involves setting the federal funds rate, an interest rate that influences other market rates such as bank loans, CD rates, and mortgage rates. Typically, higher rates will slow the economy and release some of the pressure on consumer prices. But that hasn’t happened, at least not uniformly across the economy nor at the same magnitude as previous years. One of the important things investors learned from the first quarter GDP report was the economy is less sensitive to interest rates in this cycle. Despite high interest rates and residential investment, a traditionally rate-sensitive sector contributed a respectable amount to growth in the first quarter. Of course, the dearth of housing supply drove construction activity in the first quarter, which more than offset the headwinds from higher interest rates.

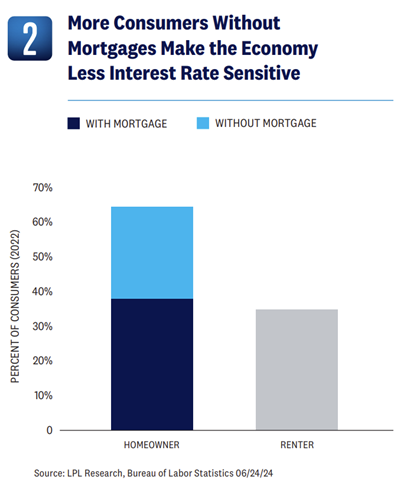

Meanwhile, the Fed is backed a little bit into a corner as some sectors of the economy appear more immune to higher interest rates than others. At this rate, we expect the Fed to stay on hold longer than they would in a normal cycle, which increases the odds of either stagflation or a bumpy landing. Some consequences of unusually low mortgage rates are a short supply of homes on the market and homebuilders needing to play catchup in an economy that overall is less rate-sensitive than ever before [Fig 2].

In a less rate-sensitive environment, tighter Fed monetary policy (higher interest rates) has a weaker effect on the economy because of the increasing share of homeowners who have no mortgage or a low fixed rate mortgage.

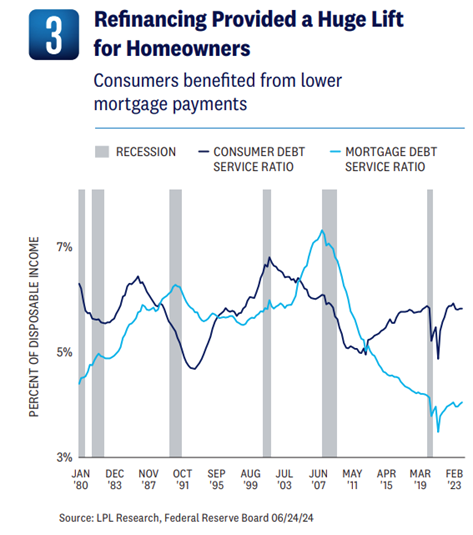

Notably, the Federal Housing Finance Agency revealed that roughly half of all mortgages have an interest rate below 4%. As millions of Americans took advantage of low rates, homeowners have historically low debt service payments as a percentage of their disposable income [Fig 3]. The New York Fed estimates that mortgagees gained an average of roughly $220 per month from refinancing. This extra cash was added to the post-COVID-19 consumer spending splurge and has delayed the inevitable weakening of economic conditions.

Optimistic on Inflation’s Trajectory, But Headline Data May Lag

We can say unequivocally that services inflation is past its peak. After an unusual spike in January, the monthly pace of services inflation slowed down to its lowest since November of last year. This trend will continue, although probably not enough for inflation to reach the Fed’s long-run target of 2% by year’s end. Core services inflation is important to watch because it reflects underlying price pressures that are less volatile than food and energy and can give a clearer picture of longer-term inflation trends. Investors should expect core services inflation to cool as labor costs decelerate.

The real problem for the Fed is that it could take some time for changes in labor costs to impact broader consumer pricing, and markets are getting increasingly frustrated with the Fed’s decision-making process. In recent years, governments have increased wages faster than the private sector to attract workers and fill open positions, but we should focus on the private sector since that is what drives business activity. The Fed will not likely begin cutting rates until they have more confirmation that consumer prices are easing, but as far as we are concerned, that is a matter of “when,” not “if”.

Labor Demand is Key to Forecasts

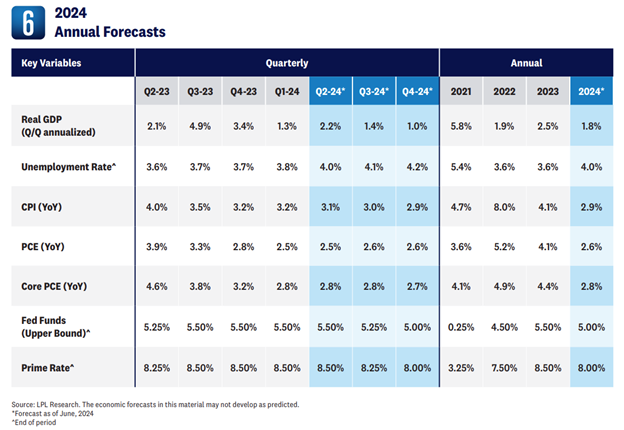

The economy will likely downshift in the latter half of 2024, as consumer spending slows from the breakneck speed of 2023. Some weakening in the labor market is expected to contribute to the economic downshift as well. The quits rate (the percentage of employees voluntarily leaving their jobs) fell as workers have become less inclined to switch jobs and the average workweek for private payrolls has declined, suggesting weaker labor demand. The unemployment rate will stay historically low but should inch up in the second half of the year. The slowing demand for labor will eventually ease inflation pressures, giving the Fed some leeway to cut rates later this year. The evidence of slower payroll growth and fewer hours worked we have witnessed imply the economy will slow at a measured pace, barring any exogenous shock [Fig 6].

THE BOTTOM LINE:

The surprisingly strong economy, fueled by high-income consumer spending and uneven interest rate sensitivity, is finally showing signs of stalling out. Expect slower spending, a softening labor market, and the beginnings of a measured economic slowdown in the latter half of 2024.

While inflation may take some time to fully ease, the Fed will likely have room to cut rates before the end of the year as the weakening economic picture becomes more apparent.

The opinions, statements and forecasts presented herein are general information only and are not intended to provide specific investment advice or recommendations for any individual. It does not take into account the specific investment objectives, tax and financial condition, or particular needs of any specific person. There is no assurance that the strategies or techniques discussed are suitable for all investors or will be successful. To determine which investment(s) may be appropriate for you, please consult your financial professional prior to investing.

Any forward-looking statements including the economic forecasts herein may not develop as predicted and are subject to change based on future market and other conditions. All performance referenced is historical and is no guarantee of future results.

References to markets, asset classes, and sectors are generally regarding the corresponding market index. Indexes are unmanaged statistical composites and cannot be invested into directly. Index performance is not indicative of the performance of any investment and does not reflect fees, expenses, or sales charges. All performance referenced is historical and is no guarantee of future results.

Alternative investments may not be suitable for all investors and should be considered as an investment for the risk capital portion of the investor’s portfolio.

The strategies employed in the management of alternative investments may accelerate the velocity of potential losses. Hedge funds are private investment partnerships that pool funds. Hedge funds use varied and complex proprietary strategies and invest or trade in complex products, including listed and unlisted derivatives. Managed futures are speculative, use significant leverage, may carry substantial charges, and should only be considered suitable for the risk capital portion of an investor’s portfolio. Private credit is non-publicly traded debt instruments created by non-bank entities, such as private credit funds or business development companies (BDCs), to fund private businesses.

Event driven strategies, such as merger arbitrage, consist of buying shares of the target company in a proposed merger and fully or partially hedging the exposure to the acquirer by shorting the stock of the acquiring company or other means. This strategy involves significant risk as events may not occur as planned and disruptions to a planned merger may result in significant loss to a hedged position. Precious metal investing involves greater fluctuation and potential for losses. Any company names noted herein are for educational purposes only and not an indication of trading intent or a solicitation of their products or services.

LPL Financial doesn’t provide research on individual equities. All index data from FactSet. All information is believed to be from reliable sources; however, LPL Financial makes no representation as to its completeness or accuracy.

GENERAL RISK DISCLOSURES

Investing involves risks including possible loss of principal. No investment strategy or risk management technique can guarantee return or eliminate risk in all market environments. There is no guarantee that a diversified portfolio will enhance overall returns or outperform a nondiversified portfolio. Diversification does not protect against market risk. Investing in foreign and emerging markets debt or securities involves special additional risks. These risks include, but are not limited to, currency risk, geopolitical risk, and risk associated with varying accounting standards. Investing in emerging markets may accentuate these risks.

This research material has been prepared by LPL Financial LLC. Tracking #585057 (Exp. 07/25)

Many people are curious to understand the potential tax benefits available to them. Questions such as “Is a 529 plan right for me and my goals?” are common, and at Capital Planning, we’ll be happy to guide you on this and any other questions you have.

We can work with you to conduct an analysis of funding needs, and provide recommendations as to investment allocation, ultimately helping you to select the right investments for your goals.

Book a discovery meeting today and speak with one of our advisors about independent financial planning with purpose, so you can focus on enjoying life.